DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 12/09/2024

Display Glass Revenues Rising Despite Soft Demand

La Jolla, CA -

- Display glass shipments declined in Q3’24 and are expected to decline further in Q4’24.

- Domestic Chinese glass makers have been adding Gen 8.5 capacity in 2023-2024.

- DSCC estimates that display glass revenues are expected to increase 13% in yen terms in 2024, but this translates to only a 5% increase in US$ terms.

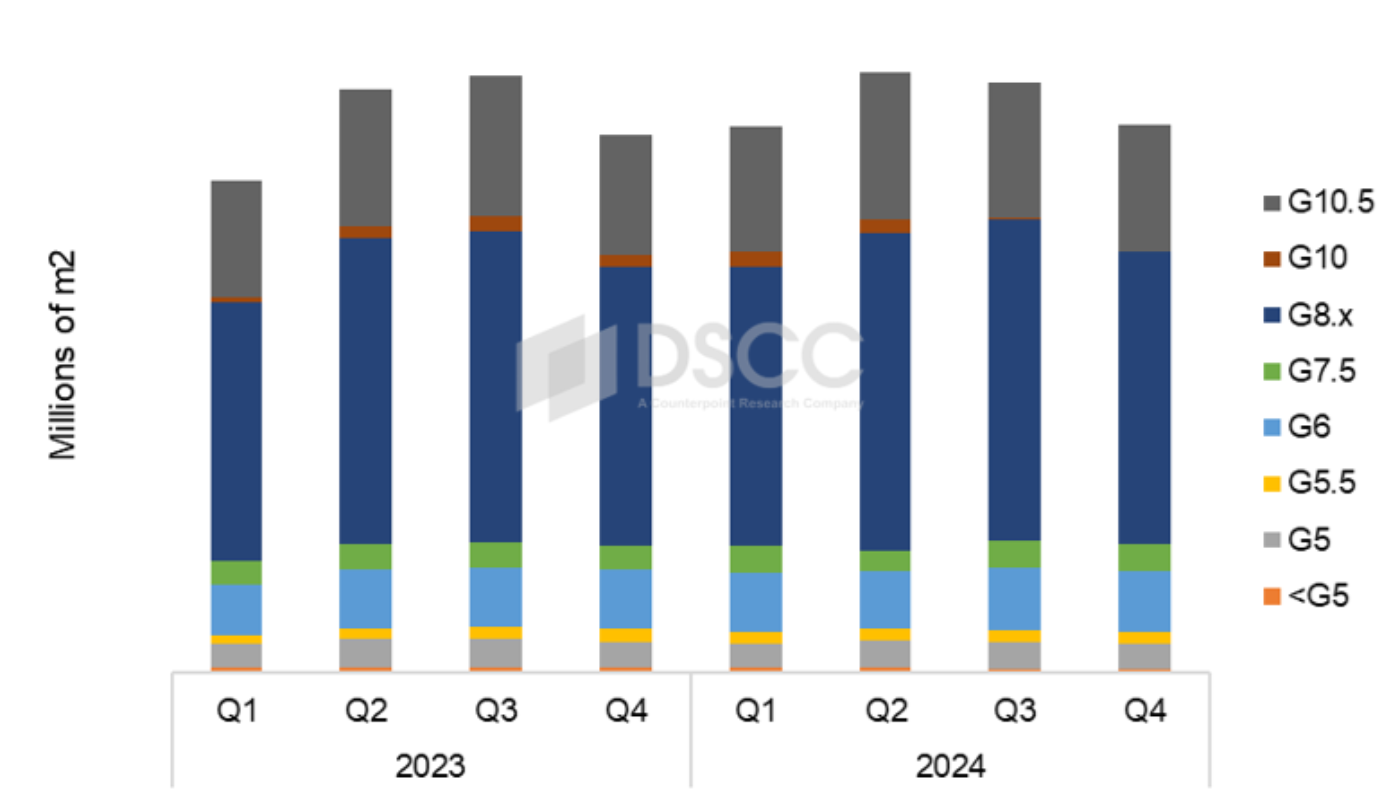

Display glass shipments declined in Q3’24 and are expected to decline further in Q4’24, but glass prices are increasing as Corning has ordered a broad price hike to compensate for the weakness of the Japanese yen. Glass makers shipments of display glass in Q3’24 declined 2% Q/Q and 1% Y/Y according to the latest update to DSCC’s Display Glass Report, released last month. Shipments are expected to decrease by 7% Q/Q in Q4’24 and to increase 2% Q/Q in Q1’25.

Domestic Chinese glass makers have been adding Gen 8.5 capacity in 2023-2024. Industry capacity for display glass increased by 1% Q/Q and 3% Y/Y in Q3’24 as all three major glass makers are managing capacity to the level of demand. Overall capacity remains substantially higher than demand, and some capacity sits idle.

After a sharp increase in Q2’24 as panel makers rushed to build TV panels for summer sporting events, display glass shipments decreased in the third quarter as panel makers edged off utilization to avoid building inventory. The peak demand for 2024 was in the second quarter, still below the level of Q1’22, which remains the high-water mark of the display glass industry.

Display Glass Shipments by Gen Size, 2023-2024

A view of the market by region demonstrates the dominance of the display industry by China panel makers and the diminished relevance of Korea in the display glass market. Ten years ago, Korea was the largest region for glass demand, but Korea’s share hit a low point of only 5% of the glass market in Q1’23 with both Samsung and LG running at low utilization to control inventory. Korea’s share has recovered slightly to 7% in 2H’24 but is unlikely to exceed that level.

After successfully implementing a price increase in 2023, Corning announced in September 2024 that it would increase prices again to compensate for the declining value of the Japanese yen. Corning said that it seeks to restore the profitability of its glass business to historical levels. DSCC estimates that prices increased 3% in Q3’24, and we forecast a price increase of 10% in Q4’24 and another 4% in Q1’25.

DSCC estimates that display glass revenues are expected to increase 13% in yen terms in 2024, but this translates to only a 5% increase in US$ terms. Corning remains the leading glass maker in volumes and revenues, but Corning’s share is edging down in 2024 as domestic Chinese glassmakers increase shipments with new Gen 8.5 capacity.

DSCC’s Display Glass Report tracks glass capacity and shipments for all major glass makers across all LCD and OLED display fabs, providing pivot tables that allow splits by region, panel maker, backplane type and TFT Gen Size. The report includes prices for a-Si and LTPS glass for Gen Sizes from 1 to 10.5 and includes quarterly history from Q1’19 and a forecast through Q1’25. Readers interested in subscribing to DSCC’s Display Glass Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.