DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 08/19/2024

Display Glass Market Jumped in Q2 But Falling in 2H’24

La Jolla, CA -

- Display glass shipments increased 12% Q/Q and 5% Y/Y in Q2’24.

- China’s share of the display glass market matched its all-time high of 73% in Q2’24.

- With increases in shipments and price, display glass revenues are expected to increase 13% in 2024 in terms of Japanese yen.

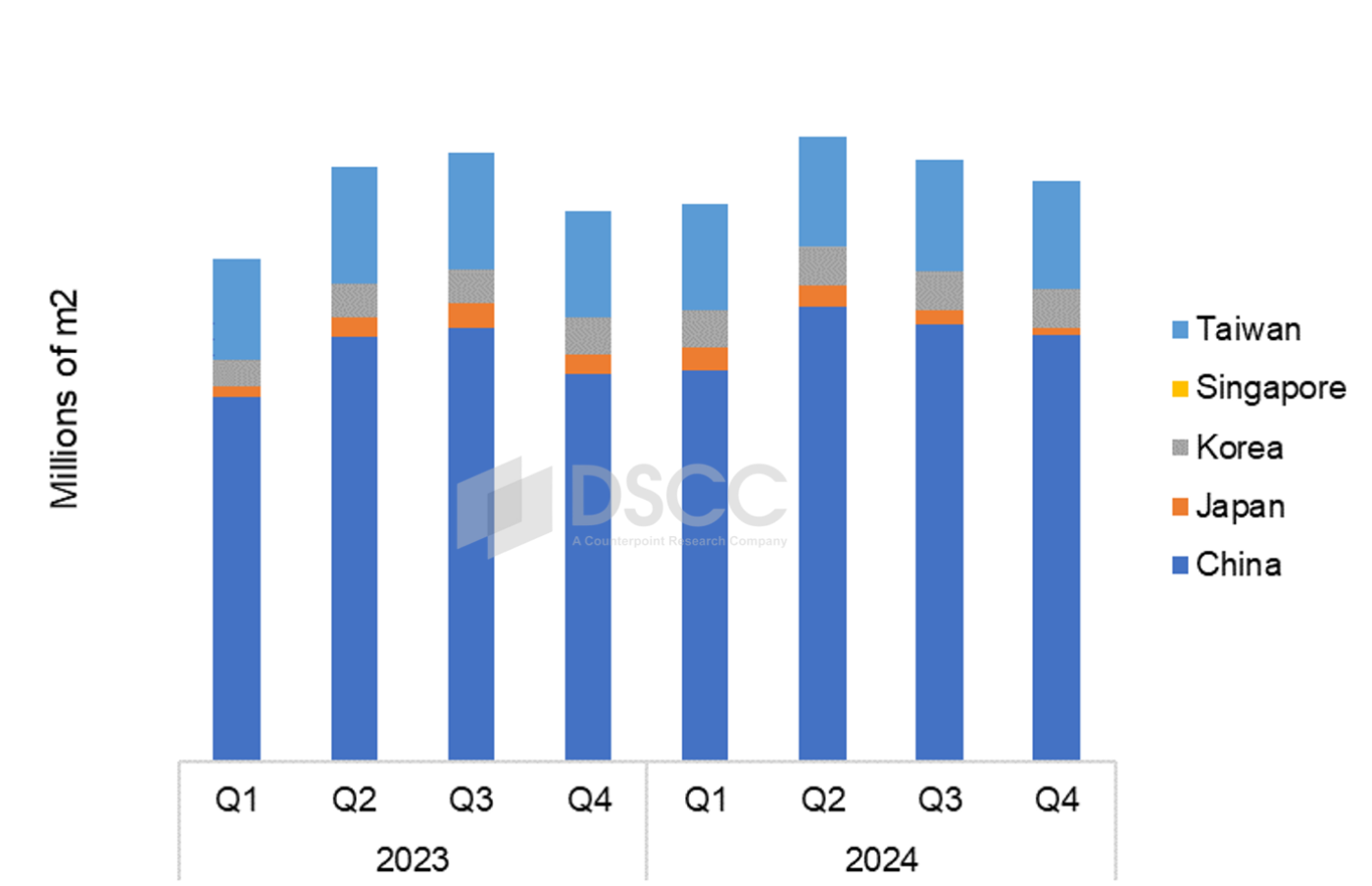

Glass makers shipped 172M m2 of display glass in Q2’24, an increase of 12% Q/Q and 5% Y/Y according to the latest update to DSCC’s Display Glass Report, released last week. China’s portion of worldwide display glass demand increased to an all-time high of 73% in Q2’24. With the coming closure of the largest fab outside China, Sharp’s Sakai Display Products Gen 10, China’s share of display glass demand will only increase. Glass shipments are expected to decrease by 4% Q/Q in Q3’24 and to decrease another 4% Q/Q in Q4’24.

The Display Glass Report tracks glass capacity and shipments for all major glass makers across all LCD and OLED display fabs. The report combines DSCC’s comprehensive insight into industry capacity and utilization with an in-depth understanding of display glass and the supply chain. The report outlines capacity by region in each of the four regions of display glass production: Japan, China, Taiwan and Korea, and covers glass shipments in Gen sizes from 1 to 10.5. The report details glass shipments for the three major suppliers to the display industry, Corning, AGC and NEG, along with other glass suppliers. The report includes a supply matrix covering 26 panel makers.

We have updated our glass capacity outlook with new intelligence this quarter on domestic Chinese glass makers. Domestic Chinese glass makers have been adding Gen 8.5 capacity in 2023-2024. Industry Capacity for display glass increased by 2% Q/Q in Q2’24 with some restarts by Corning and additions by Caihong/Irico adding to industry output.

A view of the market by region demonstrates the dominance of the display industry by China panel makers and the shrinking relevance of Korea in the display glass market. As both Samsung Display and LG Display have shifted to OLED and closed LCD lines, their total display capacity in Korea has been reduced and their glass demand has been further reduced because all the OLED capacity added since 2017 requires only one piece of glass whereas LCD requires two. Ten years ago, Korea was the largest region for glass demand, but Korea’s share hit a low point of only 5% of the glass market in Q1’23 with both Samsung and LG running at low utilization.

Display Glass Market by Region, 2023-2024

The report provides tables of glass prices by Gen size for a-Si and LTPS glass. Glass is priced in Japanese yen across the industry, and while glass prices in the display industry vary by volume and by customer, the report provides average prices.

Corning announced a price increase in May 2023, and by Q4’23 Corning declared that it had succeeded in implementing a double-digit price increase (in yen terms). We estimate that average glass prices have been flat Q/Q in both Q1 and Q2’24 and will continue to be flat in Q3’24, but Corning has signaled strongly that it will increase prices on glass to account for the weakening of the yen. We forecast a 10% increase in glass prices in Q4’24. DSCC forecasts that display glass revenues are expected to increase 13% in yen terms in 2024, but this translates to only an 8% increase in US$ terms based on an average exchange rate of ¥147/$.

DSCC’s Display Glass Report tracks glass capacity and shipments for all major glass makers across all LCD and OLED display fabs, providing pivot tables that allow splits by region, panel maker, backplane type and TFT Gen Size. The report includes prices for a-Si and LTPS glass for Gen Sizes from 1 to 10.5 and includes quarterly history from Q1’19 and a forecast through Q4’24. Readers interested in subscribing to DSCC’s Display Glass Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.