DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 11/18/2024

Display Equipment Spending Expected to Rise 47% in 2024 as Industry Rebounds

La Jolla, CA -

- Improved display industry market conditions to drive 47% growth in 2024 display equipment spending to $7.3B.

- 2025-2027 expected to hover around $7B-$8B with spending on next generation OLED fabs for IT markets a major catalyst. These new fabs should bring OLED costs down for larger (10”-20”) panels.

- OLED IT demand expected to rise at a 46% CAGR from 2023 to 2028 to over 60M panels.

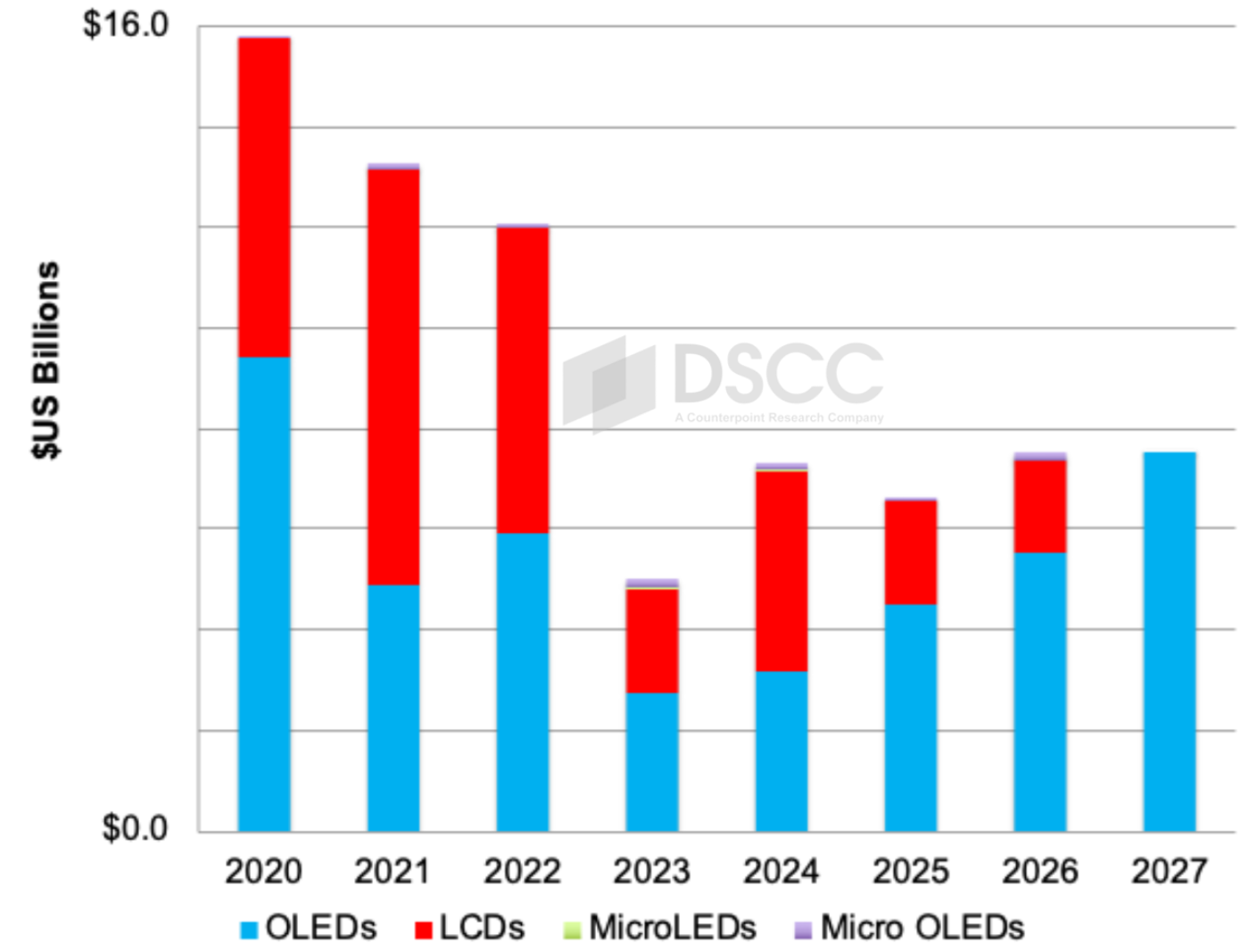

Display equipment spending is expected to bounce back from a weak 2023 and rise 47% in 2024 to $7.3B according to DSCC’s latest Quarterly Display Capex and Equipment Market Share Report. LCD equipment spending is expected to lead the way with a 54% share on 95% growth after spending was slashed 67% in 2023 due to weak post-COVID LCD market conditions, a significant LCD oversupply and net losses for LCD suppliers. As conditions have improved and demand has rebounded, LCD fab spending has increased. OLED fab equipment spending is also expected to recover in 2024, up 16%, after falling 54% in 2023 with the OLED industry not immune from LCD weakness as many of the manufacturers are the same in both technologies. While OLEDs have been taking share in many display applications, weakness in OLED TV demand has kept a lid on OLED capex.

Display Equipment Spending

Looking forward, display equipment spending is not expected to fall back to 2023 levels. Instead, spending is expected to hover around the $7B-$8B figure for the next few years as OLED fab spending grows to meet rising demand for OLEDs in most applications. In particular, the IT market consisting of laptops, tablets and monitors, is expected to surge requiring new capacity optimized for these products. Those markets are expected to rise at a 46% CAGR on a unit basis from 2023 to 2028 to over 60M panels.

Looking at the latest quarter’s new fab projects, there are a number of interesting developments.

- In OLEDs, there are a number of G8.7 IT OLED fabs coming in the forecast period which are expected to account for 52% of all display equipment spending between 2024 and 2027. These fabs are expected to reduce the costs for making 10”-20” panels for the IT markets and help boost OLED penetration in these and other markets. Mobile OLED spending is continuing as well with a couple of new G6 fab lines being added over the forecast as well as more LPTO and CoE conversions which will also help boost spending.

- In LCDs, there are a few LCD fab investments targeting ultra-large TVs 85” and over which require some specialized equipment. There are also some examples of LCD manufacturers looking to boost transparency for AR/VR applications by adopting an LTPO backplane. There is also a large LCD investment from a new player targeting the e-reader market with a new type of LCD-based reflective technology.

DSCC’s Quarterly Display Capex and Equipment Market Share Report tracks all fab projects and equipment spending in the LCD, OLED, Micro OLED and MicroLED markets. In addition, market share is provided for over 70 different equipment segments with revenues show for 175 different equipment suppliers. For more information, contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.