DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 07/24/2023

Despite Downturn in the Display Industry, DSCC Report Reveals MiniLED Shipments to Rebound in Q2’23

La Jolla, CA -

Although MiniLED shipments declined in Q1’23 due to the impact of sluggish global demand, it is believed that shipments returned to normal levels in the second quarter as inventory fell and demand recovered. DSCC’s latest release of its Quarterly MiniLED Backlight Technologies, Cost and Shipment Report revealed that MiniLED is still an indispensable driving force for the growth of the display industry. MiniLED backlight shipments were 3.9M units in Q1’23 and are expected to reach 5M units in Q2’23.

- In 2023, at Touch Taiwan and SID, many new MiniLED products were released, especially in automotive applications.

- AUO: Smart Cockpit.

- BOE: 31.5” 4K MLED embedded with COG AM, 27” Curve 4k MLED, 42” 10k MiniLED for automotive cockpit.

- Innolux: 2.56” 2117 PPI MiniLED VR display, 65” 4k MiniLED TV (2160 dimming zones).

- CSOT: MiniLED automotive displays including 12.3” driver monitor, 12.3” + 35.6” cockpit display, 15.9” freeform CID and 47.5” pillar-to-pillar display.

- As expected, Apple still dominated MiniLED shipments. MinilED iPad panel shipments dropped to 530K units and MiniLED MacBook panel shipments fell to 2.9M units in Q1’23. Q1’23 monitor panel shipments were 20K units.

- The penetration of MiniLED in automotive displays continues to steadily increase. The unique advantages of MiniLED backlights such as visible in sunlight, high contrast, a long life span and affordable cost match the requirements of automotive displays. DSCC predicts the penetration of MiniLED to reach 10% in automotive displays in 2025.

DSCC expects:

- MiniLED panel shipments for all applications to reach 30.3M panels in 2027, up from 21.6M panels in 2022.

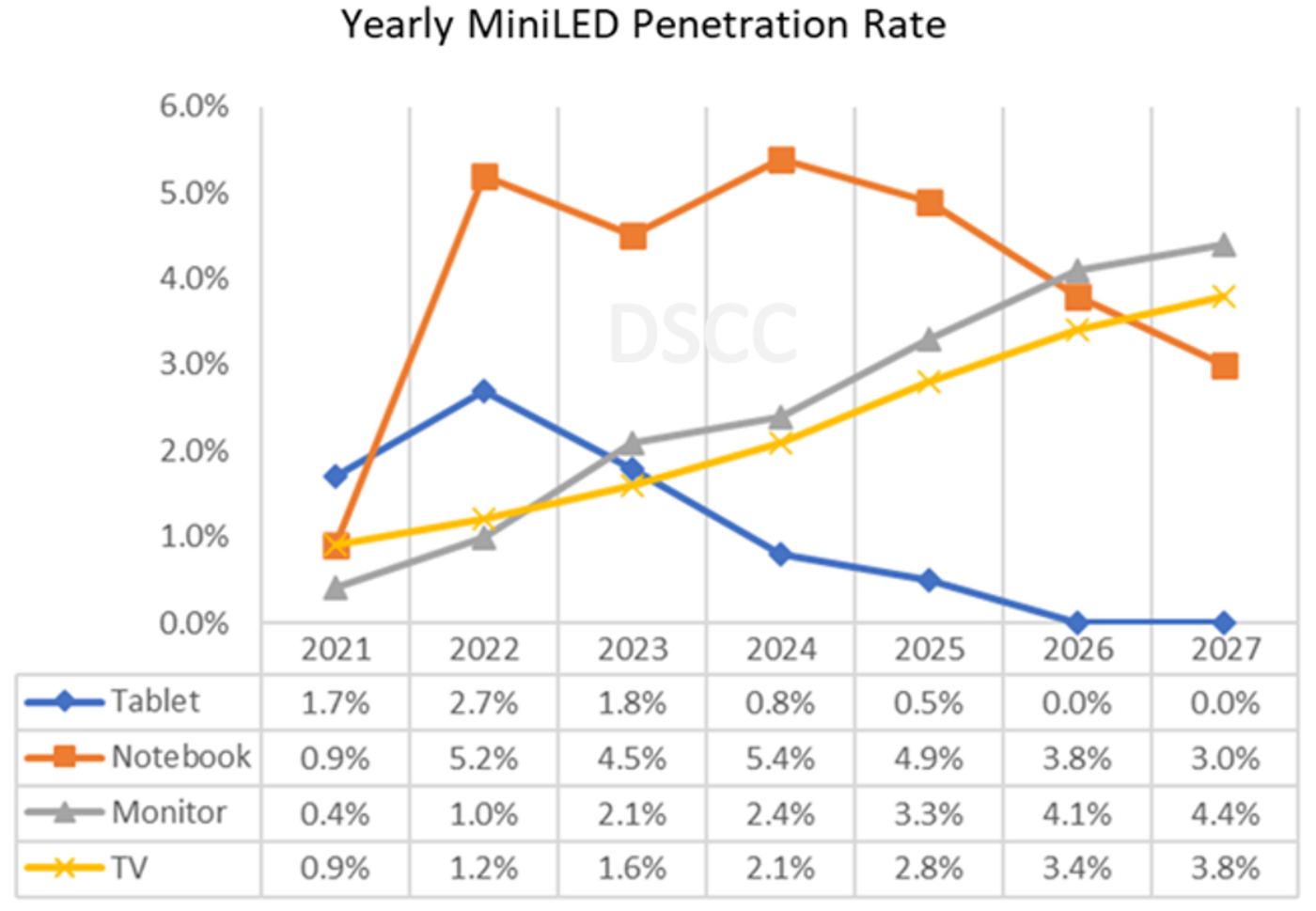

- Notebooks will be the main driving force for MiniLED growth before 2026 and the penetration in notebooks will be 4.5% in 2023 and reach 5.4% in 2024. TV will take over and become the main driving force after 2026. The penetration in TV will continue growing and is expected to be 3.8% in 2027.

- 12.9” iPad Pro and 14”/16” MacBook Pro will maintain large contributions to MiniLED tablet & notebook shipments through 2025.

- OLED will be adopted in the iPad in 2024 and in the MacBook Pro as early as 2025. This will have a big impact on MiniLED.

- Apart from IT and TV displays, MiniLED is beginning to penetrate many new applications, such as AR/VR, automotive, medical, etc.

- MiniLEDs are not only being utilized in backlights of displays, but the technology is also widely adopted in fine-pitch direct-view displays.

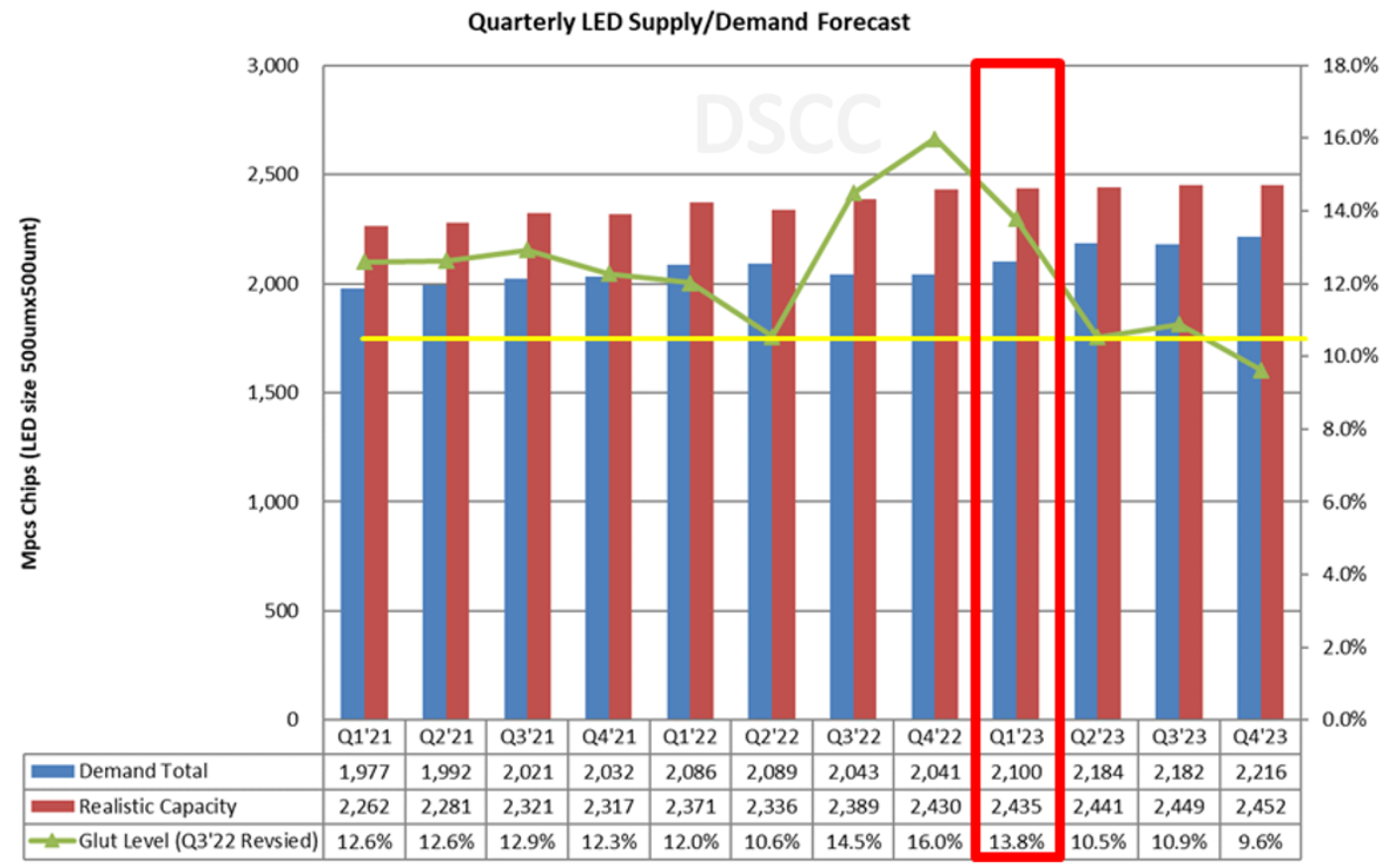

According to DSCC Director of Taiwan Operations, Leo Liu, “Thanks to the contribution from MiniLED, the supply/demand situation of LEDs has become healthier in Q1’23 and the situation looks promising for the whole year. The pressure from cost competition has been slightly eased. The glut level was 13.8% in Q1’23 and is expected to become lower than 10% by the end of this year, which means Q4’23 will be slightly tight.”

If you're interested in free expert insights, subscribe to our email list here: EXPERT INSIGHTS, FREE DELIVERY.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.