DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 03/04/2024

Chinese Brands Gained Share of Advanced TV Market in Q4'23

La Jolla, CA -

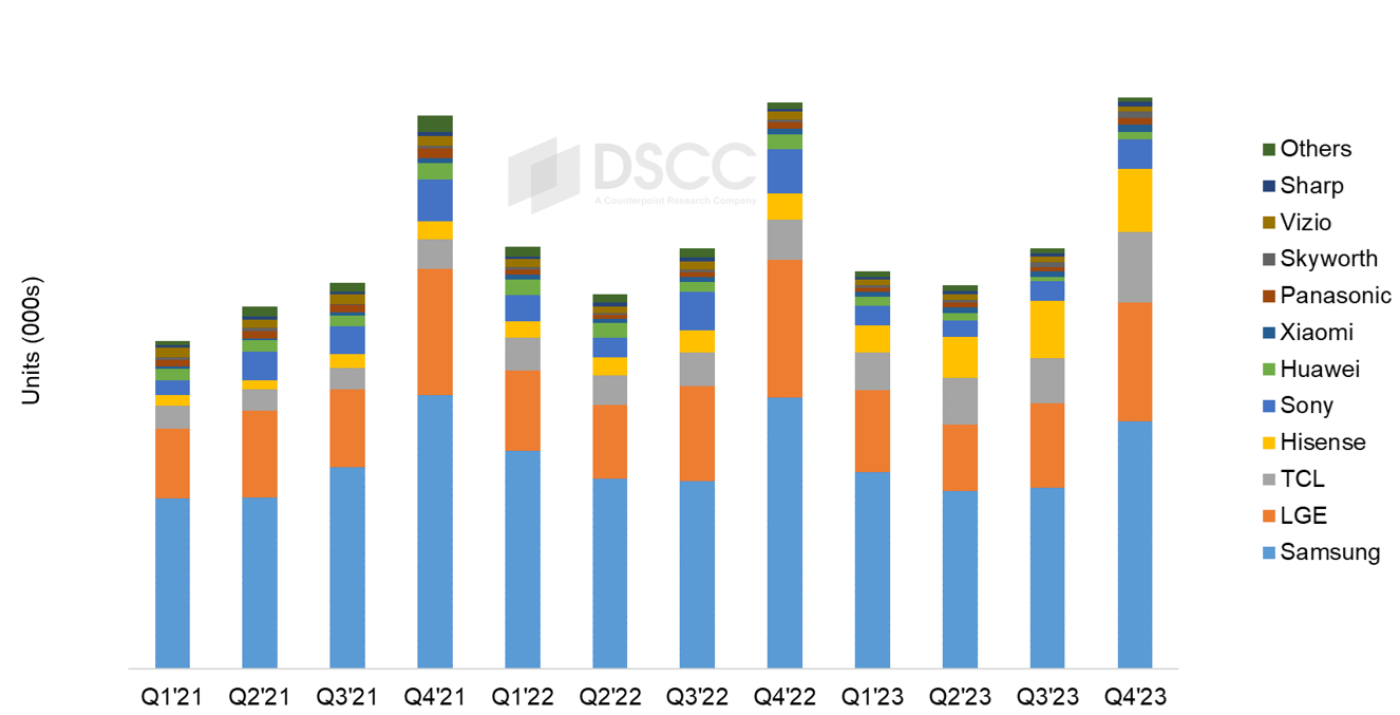

With aggressive pricing and promotion of MiniLED LCD TVs, Chinese brands led by TCL and Hisense gained share in the Advanced TV market in Q4’23, according to the latest update of DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers. The top three brands outside of China – Samsung, LG and Sony – all fared poorly while TCL and Hisense gained share in the premium segment.

Advanced TV shipments grew 1% Y/Y in Q4’23 to 6.9M units. OLED TV shipments declined 17% Y/Y to 1.9M while Advanced LCD TV shipments increased 10% Y/Y to 5.0M. Advanced TV revenues decreased by 3% Y/Y to $7.6B, the eighth consecutive quarter of Y/Y declines. OLED TV revenues decreased by 18% Y/Y to $2.8B while Advanced LCD TV revenues increased by 9% Y/Y to $4.8B as the increase in units and a richer mix overcame price declines.

In the brand battle, while Samsung maintained the top spot in both units and revenue, it lost ground while its rivals in China gained. In Q4’23, among all Advanced TV products:

- Samsung shipments declined 9% Y/Y to 3.0M units and Samsung unit share decreased by 5% Y/Y. Samsung revenues decreased 5% Y/Y and revenue share declined 1`% to 42%. Samsung continues to lead in MiniLED TV but no longer dominates as Chinese brands are accelerating. Samsung’s MiniLED shipments decreased 34% Y/Y and Samsung’s unit and revenue share declined to 39% and 44%, respectively.

- LG shipments decreased by 14% Y/Y and unit share decreased 3% Y/Y to 21% in Q4’23. LG revenues decreased 22% Y/Y and LG lost 5% share to 24%. LG continues to lead in OLED TV with 52%/50% unit/revenue share, but LG has faltered in MiniLED with only 3% share.

- TCL shipments increased 77% Y/Y and TCL gained share Y/Y from 7% to 12%. TCL revenues increased 71% Y/Y and TCL passed Sony for #3 in revenue share with 11%.

- Hisense also passed Sony to take #4 in both shipments and revenue as shipments increased 135% Y/Y and revenues increased 116% Y/Y.

- Sony shipments declined 33% Y/Y and Sony dropped from #3 to #5 in both unit and revenue share. Sony revenues declined 35% Y/Y.

Advanced TV Shipments by Brand, 2021 to 2023

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment results from Q1’18 through Q4’23, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast for five years across technology, region, resolution and size. Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.