DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 08/26/2024

Chinese Brands Gain Share in Advanced TV Market as MiniLED TVs Surpass OLED TV in Q2'24

La Jolla, CA -

- Advanced TV shipments increased 44% Y/Y in Q2’24 and revenues increased by 28% Y/Y.

- MiniLED TV shipments surpassed OLED TV in both shipments and revenues.

- TCL and Hisense gained share of Advanced TVs and Xiaomi passed Sony to take the #5 share spot.

With aggressive pricing and promotion of MiniLED LCD TVs, Chinese brands led by TCL and Hisense gained share and drove growth in the Advanced TV market in Q2’24, according to the latest update of DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers. For the first time ever, shipments of MiniLED TVs surpassed shipments of OLED TVs, and MiniLED TVs captured more than 50% share of both units and revenues in the “super premium” category. Samsung fared poorly and lost share in Advanced TVs while TCL and Hisense gained share and Xiaomi emerged to break into the top five in the premium segment.

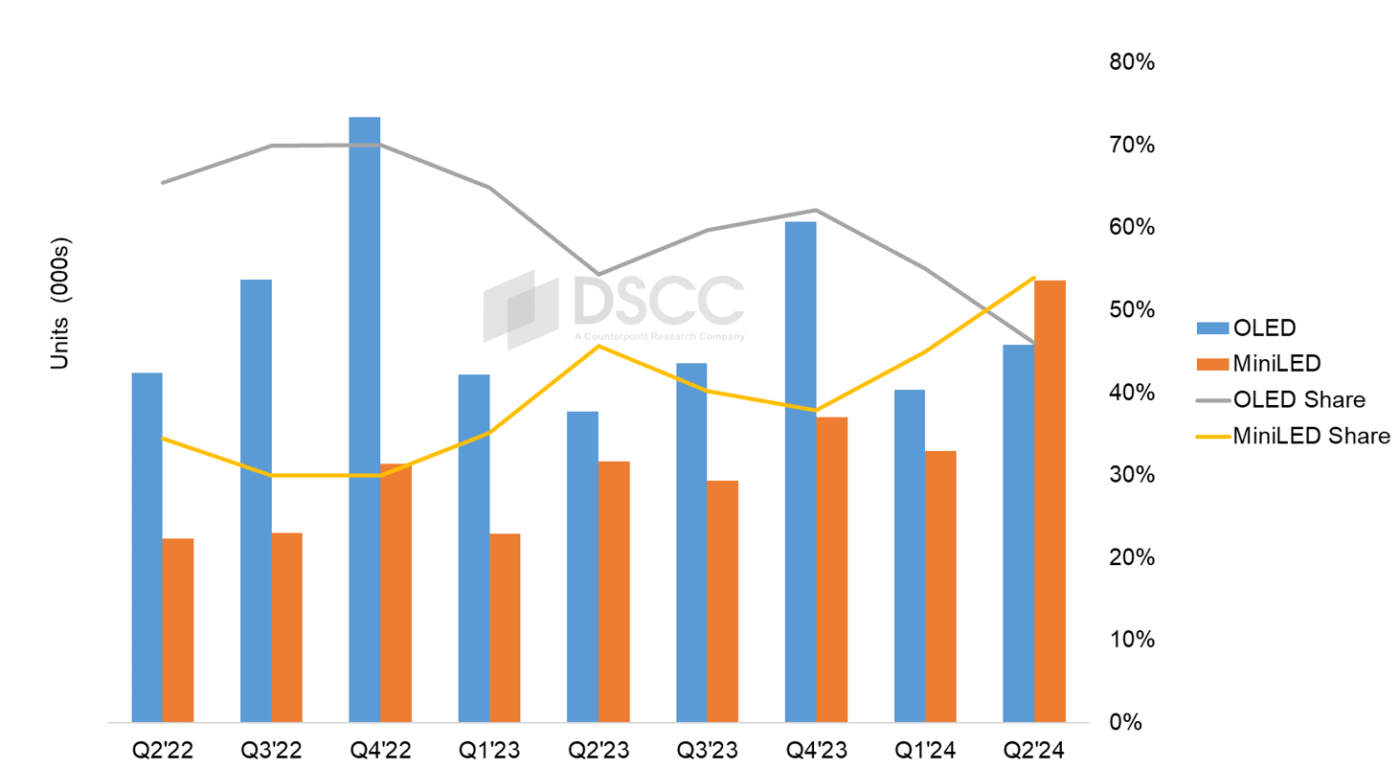

Advanced TV shipments grew 44% Y/Y in Q2’24. OLED TV shipments increased 21% Y/Y while Advanced LCD TV shipments increased 52% Y/Y. Advanced TV revenues increased by 28% Y/Y, the second consecutive quarter of increases after eight quarters of Y/Y declines in 2022 and 2023. OLED TV revenues increased by 5% Y/Y while Advanced LCD TV revenues increased by 41% Y/Y as the increase in units and a richer mix overcame price declines.

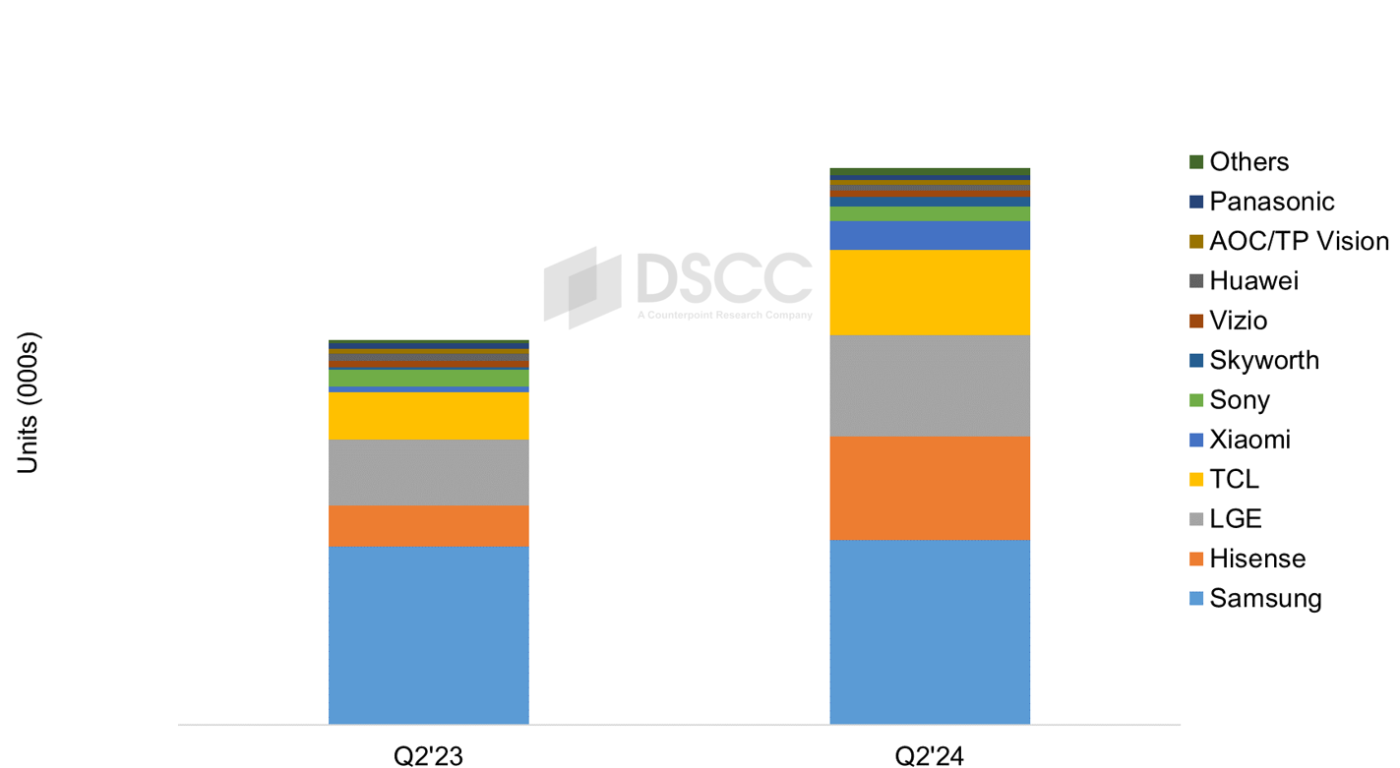

In the brand battle, while Samsung held on to the top spot in both units and revenue, it lost ground while its rivals in China gained. In Q2’24, among all Advanced TV products:

- Samsung’s unit and revenue share declined as units increased only 3% Y/Y and revenues declined 13% Y/Y. Samsung MiniLED shipments decreased 19% Y/Y and Samsung unit share in MiniLED declined to 23%.

- Hisense took the #2 position in units as shipments increased 157% Y/Y, its fifth consecutive quarter of triple digit percent gains, and revenues increased 128% Y/Y.

- LG shipments increased 53% Y/Y, and its unit share increased, but revenue share decreased as LG revenues increased 27% Y/Y.

- TCL remained in the #4 position but gained unit and revenue share as shipments increased 78% Y/Y revenues increased 81% Y/Y. TCL passed Samsung to take the lead in MiniLED TV units and came within 1% of Samsung’s revenue share.

- Xiaomi jumped into the #5 spot as shipments increased 433% Y/Y and revenues increased 713% Y/Y. Xiaomi took the #3 spot in MiniLED units and revenue.

- Sony’s shipments declined 16% Y/Y and revenues fell 29% Y/Y and Sony fell out of the top five in Q2’24.

Advanced TV Shipments by Brand, 2023 to 2024

Total MiniLED TV shipments in Q2’24 increased by 68% Y/Y and revenues increased by 60% Y/Y. OLED TV shipments increased by 21% Y/Y and revenues increased by 5% Y/Y. For the first time ever MiniLED surpassed OLED in both shipments and revenue, as MiniLED captured 54% share in both categories with OLED getting 46%, a flip from a year ago when the numbers were reversed.

OLED TV and MiniLED TV Shipments, 2022-2024

TCL pioneered the MiniLED TV category with its first products in 2019, but volumes were initially low. Samsung came in in 2021 and quickly dominated the category, and Samsung held the highest share of MiniLED in every quarter from Q2'21 through Q1'24, but TCL regained the lead in the second quarter with more than 50% Y/Y growth while Samsung MiniLED TV shipments declined.

While the share gains by Chinese brands were partly a result of the surging demand in their home market, TCL and Hisense also gained share in both Western Europe and North America. Hisense’s unit/revenue share in North America increased from 8%/6% in Q2'23 to 26%/19% in Q2'24.

Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research is a tech market research firm providing market data, industry thought leadership and consulting across the technology ecosystem. We advise a diverse range of clients spanning smartphone OEMs to chipmakers, channel players to big brands and Big Tech through our offices which serve the major innovation hubs, manufacturing clusters and commercial centers globally. Our analyst team engages with C-suite through to strategy, AR, MI, BI, product and marketing professionals in the delivery of our research and services. Our key areas of coverage: AI, Autos, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks & Infra, Semiconductors, Smartphones and Wearables. Visit the Counterpoint Library of publicly available market data, insights and thought-leadership to understand our focus, meet our analysts and start a conversation.