DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 01/08/2024

AMOLED Evaporation Materials Market to Grow to $2.7B by 2027, Phosphorescent Blue Update

La Jolla, CA -

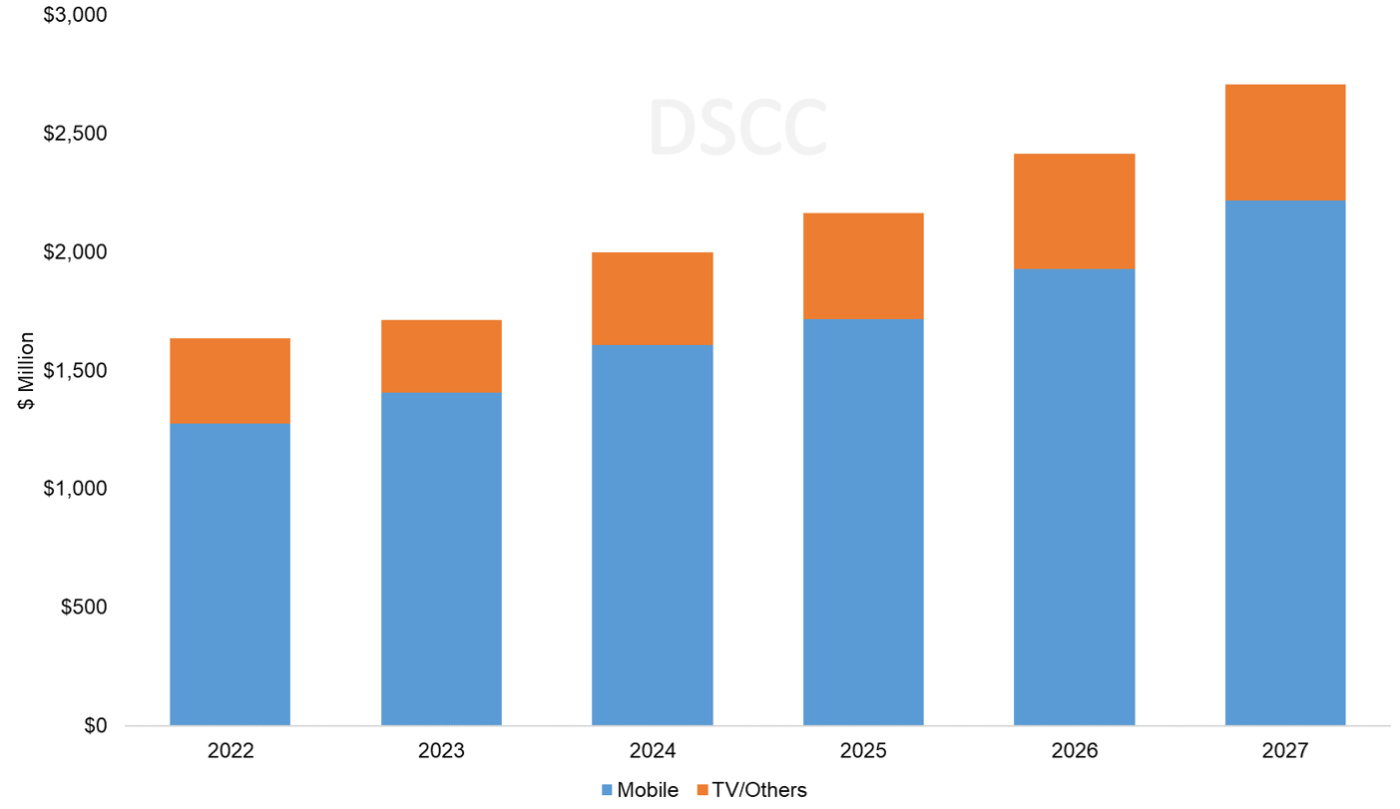

The revenue for AMOLED evaporation materials for all applications is expected to grow 1% Y/Y to $1.7B in 2023 and expected to grow to $2.7B in 2027, an 11% CAGR (2023-2027), according to the latest update of DSCC’s Biannual AMOLED Materials Report. According to DSCC Senior Analyst of Display Components and Materials Kyle Jang, "Revenues can be hundreds of millions of dollars higher in 2027 if Universal Display Corporation (UDC) successfully commercializes a blue phosphorescent emitter dopant, as they have announced. The report details all aspects of AMOLED materials, including multiple applications, supplier matrices and cost comparisons."

The January 2024 report incorporates the latest update to DSCC’s capacity and utilization outlook for AMOLED; both mobile and TV demand have been adjusted slightly compared to our prior forecast. The report includes a base case scenario that assumes the industry continues to use fluorescent blue emitters and includes a special additional scenario outlining the additional revenue generated by phosphorescent blue.

The most significant change in this report is the inclusion of recycled materials, allowing it to encompass the entire evaporation material market for mass production AMOLED from various evaporation materials companies. In addition, it features improved market accuracy by incorporating more realistic thicknesses, ASPs and material utilization.

DSCC's forecast for AMOLED material revenues by application is shown in the first chart here. Revenues from TV and other large screen applications are expected to grow from $305M in 2023 to $492M in 2027, a 13% CAGR. Mobile applications will continue to represent a majority of OLED material sales, growing at a 12% CAGR to $1.8B in 2027. DSCC expects revenues from IT (Tandem structure) to increase by a 79% CAGR in 2023-2027 to nearly $443M in 2027.

AMOLED Material Revenues by Application, 2022-2027

The report details the OLED stack configurations of all the major AMOLED product architectures, including Small/Medium panels with single and tandem structures, White OLED (WOLED) by LGD for TV panels and QD-OLED by Samsung. The stack profiles, along with estimates of material thickness, material utilization and material prices form a picture of the unyielded stack cost for each AMOLED product architecture.

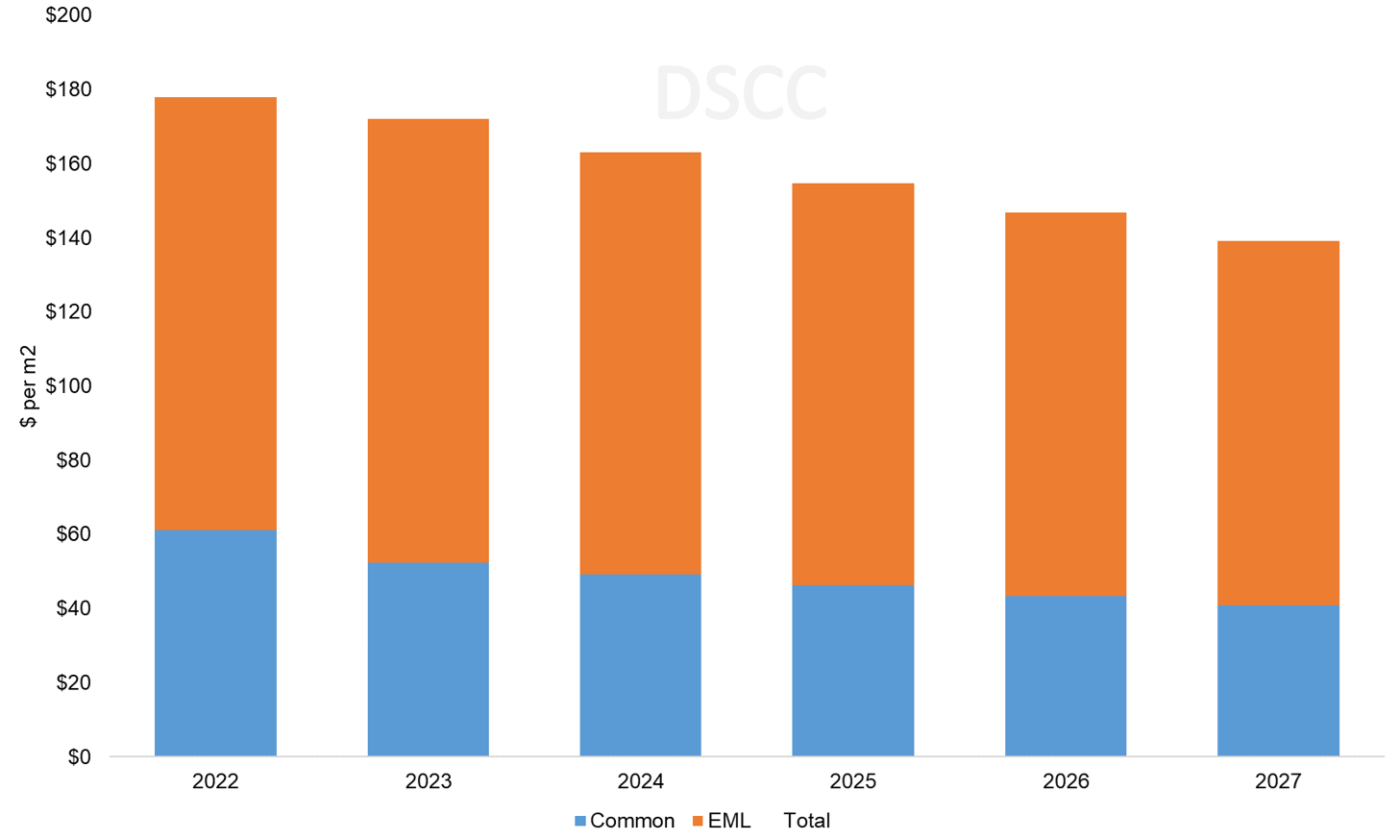

The following chart shows our outlook for the expected material cost for tandem structure OLED panels. DSCC expects that steady, incremental improvements in material utilization and price will help SDC/LGD drive the unyielded stack cost from $172 per square meter in 2023 to $139 per square meter in 2027, an average decrease of 5% per year. In addition, DSCC forecasts that yields will also improve over time with increased experience, resulting in cost reductions for yielded OLED stack materials.

The tandem structure involves the stacking of R/G/B emitting layers twice, with the addition of a charge generation layer (CGL). This results in a cost increase of nearly twice as much compared to the traditional R/G/B single stack. However, efforts are made to optimize optical effects by reducing the thickness of the common layer, designing it to be 1.5 times or less compared to the single-stack thickness. In the future, tandem structures are expected to be the main application for OLED panels in the IT sector, leading to anticipated high growth.

Unyielded Material Cost per m2 for Tandem OLED Panels

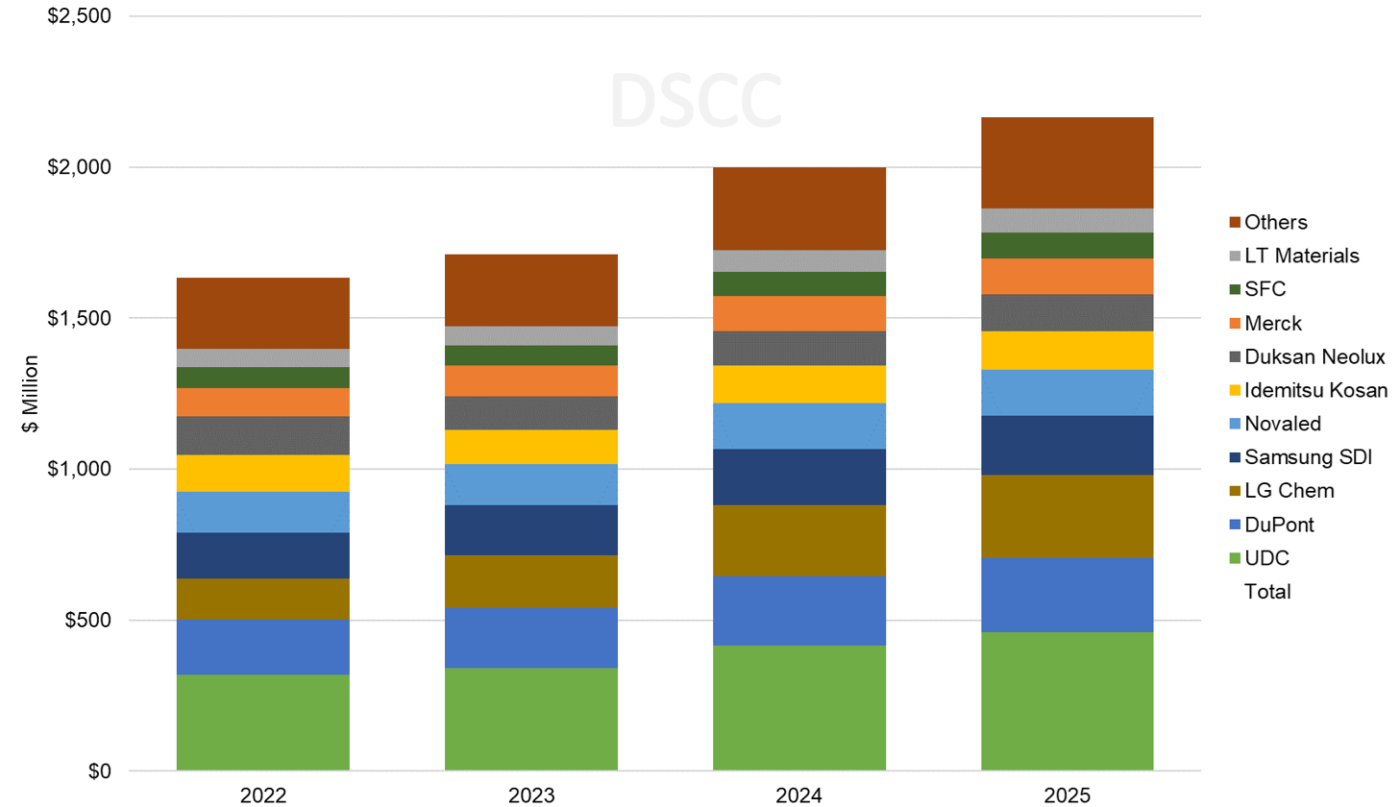

Based on the existing supplier matrix including some shifts in suppliers in 2023, the report includes a projection of AMOLED material revenues by supplier, as shown in the next chart. UDC has been the #1 supplier in revenues for the industry, and DSCC expects that to continue. DuPont, LG Chemical and Samsung SDI hold the number two through four positions among materials suppliers. These four companies are expected to capture 51% of industry revenues in 2023, but as the chart indicates, there is a long tail of companies supplying materials into the industry.

AMOLED Materials Revenues by Supplier, 2022 – 2025

The most recent edition of the report includes a scenario estimating the additional OLED material revenues generated from the potential shift from fluorescent to phosphorescent blue emitters. In February 2022, UDC announced that it was on track to enable the introduction of phosphorescent blue OLED into the commercial market in 2024. UDC has largely confirmed this timeline in subsequent announcements, although at Display Week 2023, UDC clarified that they expect to have a phosphorescent blue that is commercially available in 2024, but that the timetable for devices using the new material would be up to their clients. However, due to lower lifespans of phosphorescent blue, it appears there might be a delay until 2025. Consequently, the transition to phosphorescent is expected to be slower than our previous forecast. Nevertheless, it is evident that if this shift occurs, it will serve as a catalyst for the accelerated growth of the entire OLED industry.

The technology sections have also been updated to align with current development trends and address pertinent issues. DSCC covers various technologies and concerns aimed at enhancing the lifespan and efficiency of OLED panels, with a specific focus on material technology. A key trend in evaporation material is deuterium-substituted technology, which enhances material lifespan by forming stronger bonds with carbon compared to hydrogen. SDC and LGD have adopted deuterium for Green/Blue and have plans to apply it to Red for mobile applications. In the realm of TVs, both companies are adopting deuterium blue, with differences noted by SDC/LGD for other colors. The expected rapid increase in deuterium usage comes with challenges such as IP concerns, limited suppliers and high costs. Beyond deuterium substitution, this report covers a range of technologies, including phosphorescent, TADF, Hyper-fluorescence, Tandem Stack, 4 Stacks, CPL, CoE, MLA and more.

The DSCC Biannual AMOLED Materials Report includes profiles for major panel maker’s AMOLED stack architectures and supply chain including single stack/tandem stack/WOLED/QD-OLED, supplier matrices for the main OLED panel makers and revenue projections for 18 different material types and 21 material suppliers. For more information about the report, please e-mail info@displaysupplychain.com, or contact your regional DSCC office in China, Japan or Korea.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.