Counterpoint Research

info@counterpointresearch.com

FOR IMMEDIATE RELEASE: 01/21/2025

AMOLED Evaporation Materials Market: LG Chem May Take 2nd Spot From DuPont in 2025; UDC to Remain Leader

-

- DuPont is likely to maintain its second place position in 2024, but LG Chemical may overtake it in 2025.

- UDC is projected to retain its position as the leader.

- Growth in the Next-generation Blue market is expected to be delayed until after 2026 due to challenges in achieving lifespan.

DuPont is expected to maintain its second place position in the AMOLED evaporation materials market in 2024, but LG Chemical may overtake it in 2025, according to Counterpoint’s Semi-Annual AMOLED Materials Report. UDC will continue to lead the market both in 2024 and 2025.

Although LG Chemical was expected to surpass DuPont and secure the second spot in the first half of 2024 due to the expansion of supply materials and customers, market conditions changed, leading to DuPont maintaining its second place. The following factors contributed to this outcome:

- Slow recovery in LG Display’s WOLED utilization rate.

- Decreased demand for OLED iPads.

- Chinese panel makers' increased adoption of AMOLED evaporation materials from local suppliers.

Kyle Jang, Senior Analyst at Counterpoint, said, “After 2025, market share rankings in the AMOLED evaporation materials market may change frequently due to intensified competition with local Chinese suppliers and the adoption of new structures from AMOLED panel makers.”

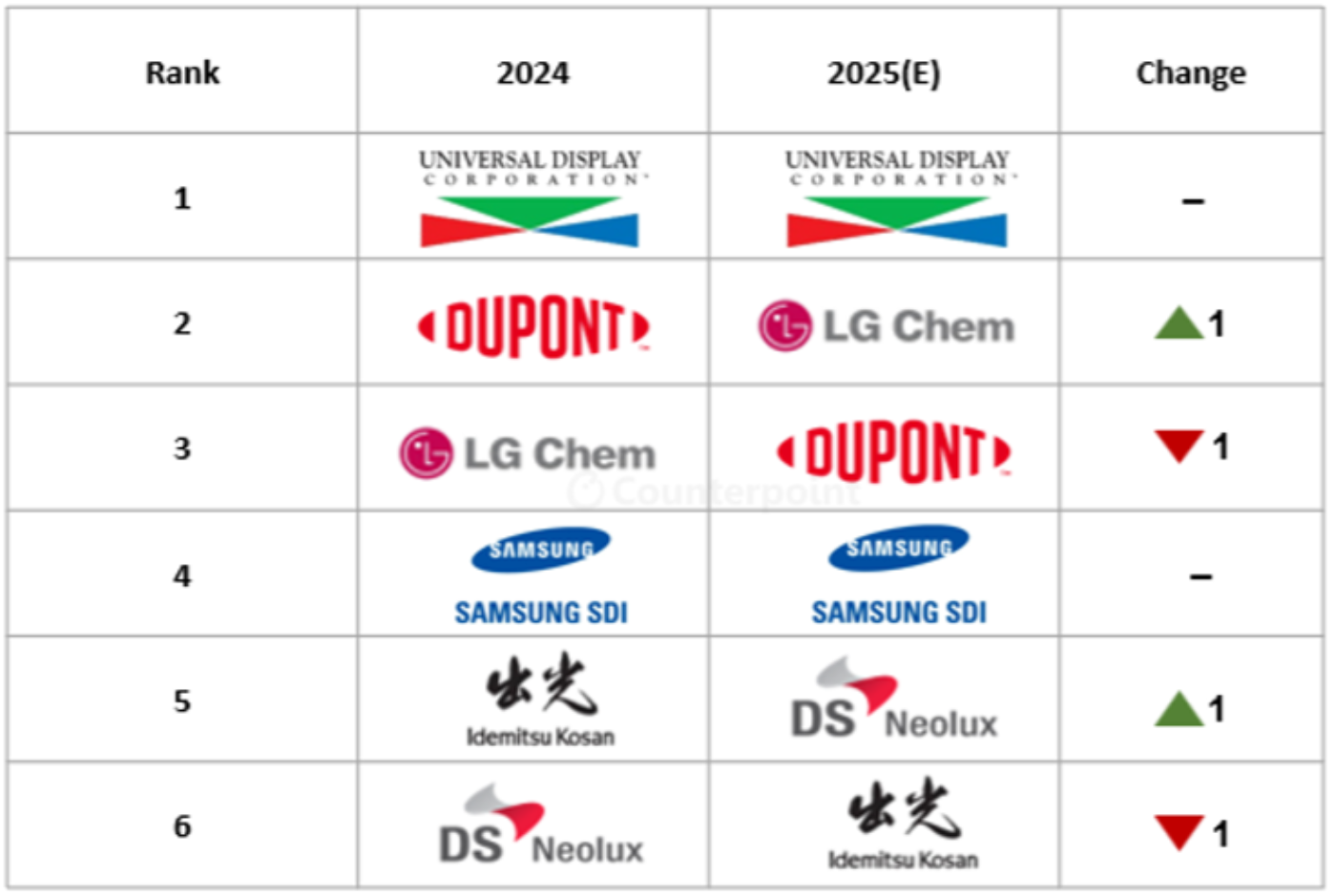

Ranking Changes of Major AMOLED Evaporation Materials Companies

The Counterpoint report also addresses one of the key issues in the AMOLED materials market – Next-generation Blue. Next-generation Blue refers to technologies that can replace fluorescent blue, such as TADF (Thermally Activated Delayed Fluorescence), HF (Hyperfluorescent) and Phosphorescent technologies.

Visionox has succeeded in commercializing HF blue earlier than expected, but the initial supply volume is expected to be limited. Furthermore, the most promising phosphorescent blue continues to face challenges in securing lifespan, leading to projections that its market launch will be delayed from the previously expected 2025 end to after 2026.

For Next-generation Blue to grow into a meaningful market size, the speed at which solutions to lifespan issues (like integration with tandem structures) are developed will be crucial.

Counterpoint’s latest Semi-Annual AMOLED Materials Report covers:

- Major panel makers’ AMOLED stack architectures and supply chain

- Chinese OLED materials market

- AMOLED market results and forecast by material maker, panel maker, layer and technology

- Status of Next-generation Blue – TADF, Hyperfluorescence, Phosphorescence

- Technology issues and development trends – Tandem, High Efficiency, New Materials, Advanced Technologies

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.