DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 01/08/2024

After a Miserable 2023, Recovery for Advanced TV Market Expected to Start in 2024 with Long Term Growth Projected

La Jolla, CA -

Advanced TV shipments declined in both units and revenue in 2023, but both units and revenue are forecasted to resume growth in 2024, according to the latest update to DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers. This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD-OLED, QDEF, MicroLED and MiniLED with 4K and 8K resolution. The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and screen size, and forecasts the growth of all these technologies.

In this report, DSCC defines an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The forecast in the report allows analysis by feature for Advanced LCD TVs, including:

- QD LCD TV: TV using a Quantum Dot Enhancement Film (QDEF); these TVs are sold as “QLED” by Samsung, TCL and others;

- MiniLED: LCD TVs with a MiniLED backlight, as sold by TCL starting in 2019 with many brands following. Note that DSCC expects that all MiniLED TVs will also have QDEF, but not all QDEF will have MiniLED;

- QD-OLED: Quantum Dot OLED, Samsung Display’s large-screen OLED technology;

- MicroLED: Samsung direct-view MicroLED TVs with sizes from 88”-110”, marketed as TVs for wealthy consumers. Our report excludes larger MicroLED products such as the 146” and 292” “The Wall” products sold by Samsung, as these are primarily business displays.

Two Advanced TV technologies appear in our historical data but are not included in our forecasts, because both technologies appear to be discontinued.

- Dual Cell: LCD TVs employing dual-cell technology, as introduced by Hisense in 2019. Dual Cell appears to be phased out in TV, DSCC forecasts zero volume for this technology starting in 2022;

- Rollable OLED TV, introduced by LG in 2021, has been discontinued in 2022.

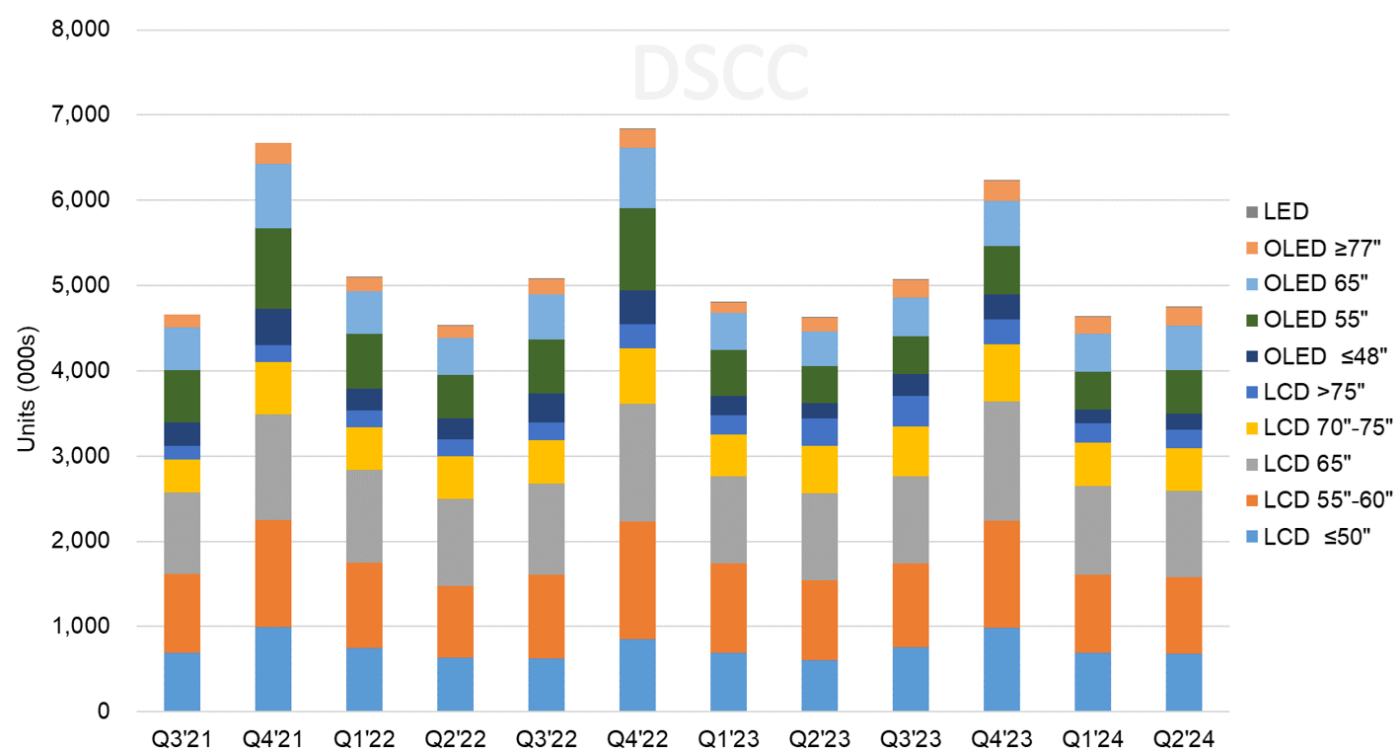

The first chart here shows our outlook for Advanced TV shipments by quarter and by technology and screen size group.

DSCC estimates that total Advanced TV shipments declined 9% Y/Y in Q4’23 and forecast a 4% Y/Y decline in Q1’24 but a return to growth with a 3% increase Y/Y in Q2’24. DSCC estimates that OLED TV units decreased 29% Y/Y in Q4’23 and forecast a decline of 6% Y/Y in Q1’24 but expect a return to growth with an increase of 21% Y/Y in Q2’24 compared to a very weak Q2’23. DSCC estimates that Advanced LCD TV units increased 1% Y/Y in Q4’23 but expect them to decrease 3% Y/Y in Q1’24 and decrease 4% Y/Y in Q2’24

Quarterly Advanced TV Shipments by Screen Size and Technology, Q3’21 to Q2’24

For the full year 2023, DSCC estimates that Advanced TV shipments declined by 4% Y/Y with OLED shipments declining 20% Y/Y and Advanced LCD TV shipments increasing 4% Y/Y. DSCC estimates Advanced TV revenues for the full year 2023 declined by 8% Y/Y, with OLED TV revenues declining by 18% Y/Y and Advanced LCD TV revenues declining by 1% Y/Y.

In the first half of 2024, DSCC forecasts that Advanced TV revenues will decline 2% Y/Y, with OLED TV revenues increasing 4% Y/Y and Advanced LCD TV revenues declining 5% Y/Y.

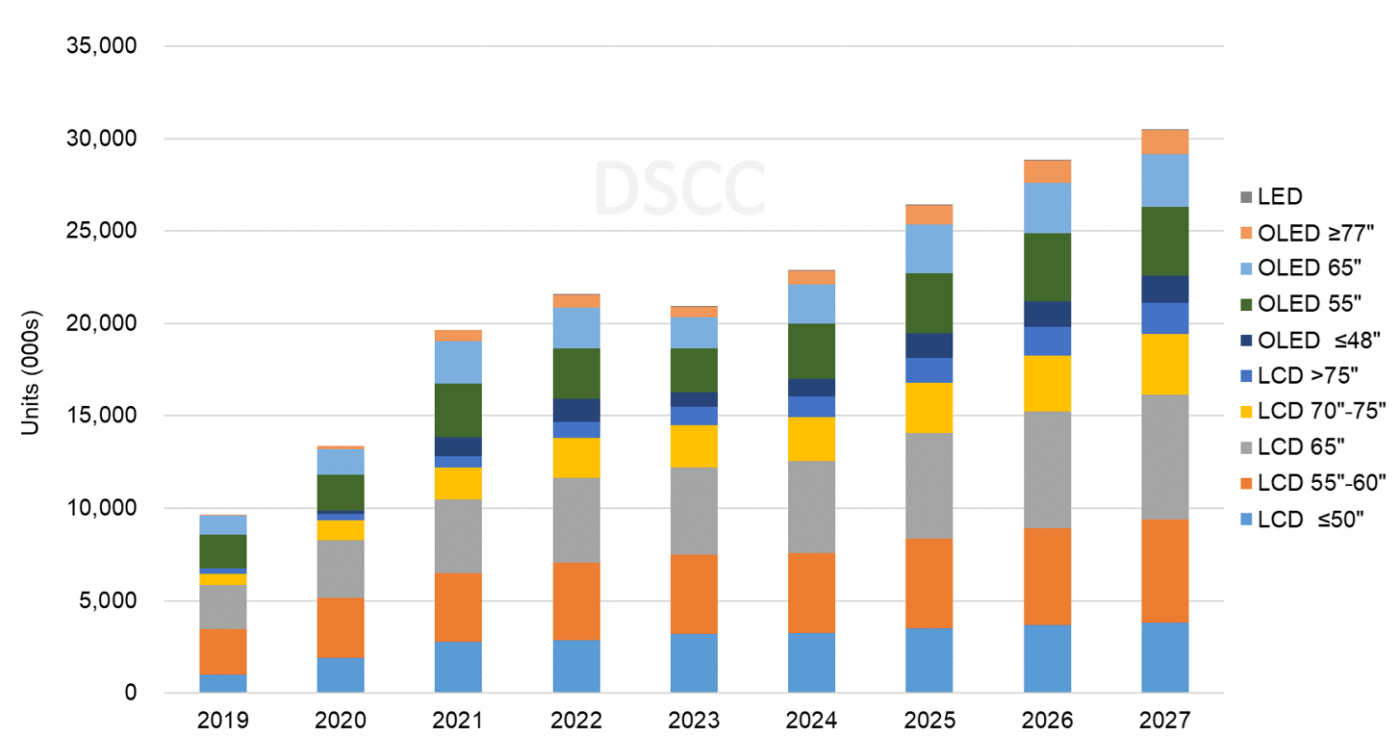

In our updated long-term forecast, after a 4% Y/Y decline in 2023, total Advanced TV shipments are expected to grow by a 10% CAGR from 2023 to 2027 to 30M units. DSCC estimates that OLED TV units declined 20% in 2023 but DSCC expects them to grow at a 14% CAGR from 2023-2027 to 9.2M units. DSCC estimates that Advanced LCD TV units increased by 4% Y/Y in 2023 and expect them to grow at an 8% CAGR from 2023-2027 to 20.7M units. Including QD-OLED, OLED TV will achieve a 31% share of Advanced TVs in 2027. MicroLED TV will emerge with very small volumes.

Advanced TV Shipments by Screen Size and Technology, 2019 to 2027

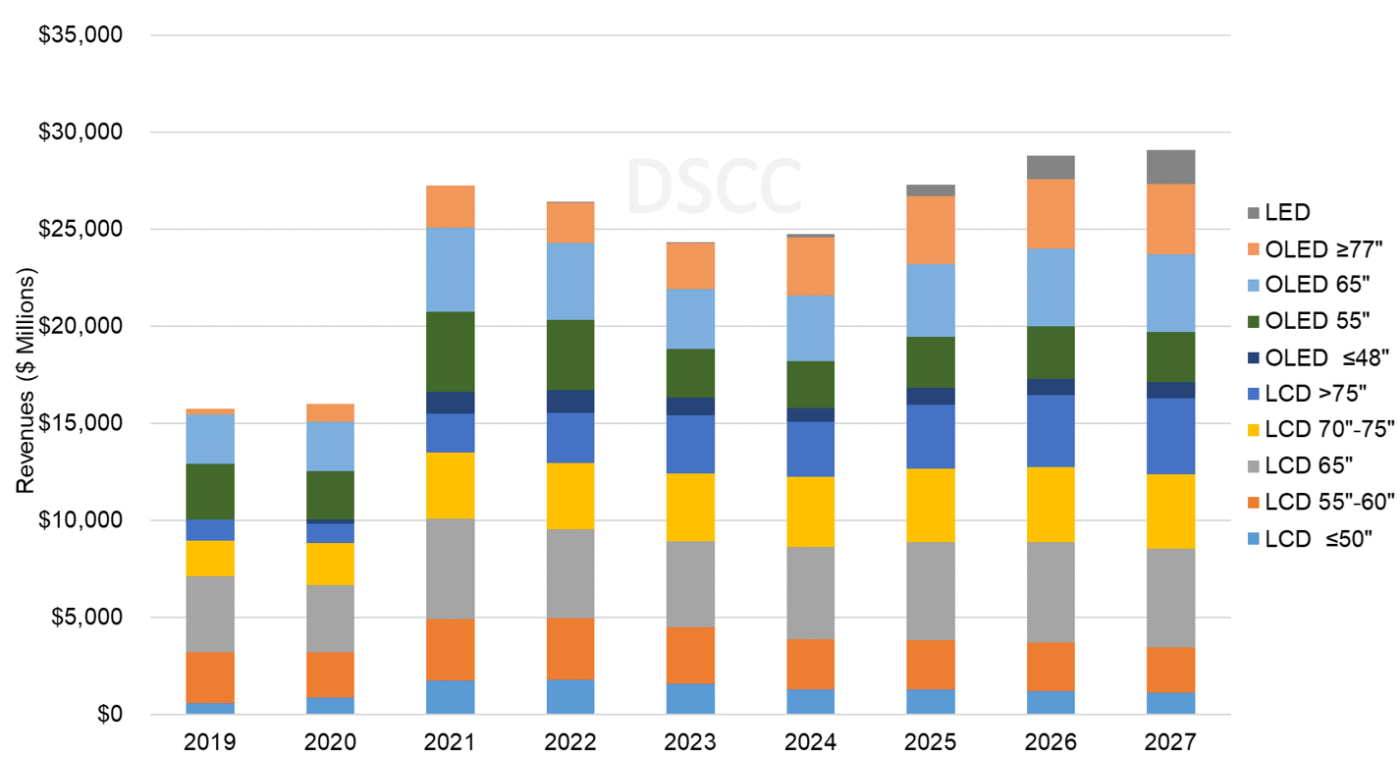

Advanced TV revenues jumped in 2021 with pandemic-fed demand and higher prices. Revenues declined in 2022 by 3% as price declines overwhelmed volume increases, and DSCC expects revenues to decline further in 2023 by 12% as prices continue to decline with soft demand. DSCC expects revenue growth to resume in 2024 and expects revenues to grow at a 6% CAGR from 2023-2027 to $29.3B, driven by increasing volumes, larger screen sizes and new technologies. DSCC forecasts that OLED TV revenues, including QD-OLED, will grow by 7% to $10.9B in 2027 and that Advanced LCD TV revenues will grow by 2% to $16.7B, with the Advanced LCD TV revenue share declining to 57% in 2027. DSCC expects that MicroLED will emerge as the super-premium TV to capture $1.7B or 6% of Advanced TV revenues with only 0.1% of units.

Advanced TV Revenues by Screen Size and Technology, 2019 to 2027

The report divides worldwide shipments into eight geographic regions, and DSCC expects that Western Europe and North America will continue to be the largest regions for Advanced TV, but their combined share will slowly decline as growth is faster in Asia. DSCC estimates the overall market declined by 4% Y/Y in 2023 with Japan, Western Europe and North America declining as a result of weak post-pandemic demand. China is estimated to have 9% Y/Y growth in 2023 and Asia Pacific is estimated to have 8% growth.

North America and Europe will continue to be the largest regions for Advanced TV in terms of revenues. In 2023, DSCC estimates these regions to account for a 56% revenue share, down from 62% in 2022 on gains from China and the Asia Pacific. DSCC estimates that total Advanced TV revenues declined by 8% Y/Y in 2023 with big declines in North America, Western Europe and Japan. Revenues increased Y/Y in China, Asia Pacific, Latin America and MEA.

DSCC sees two main technology battles in the Advanced TV market. The first battle is within OLED TV where Samsung Display’s QD-OLED technology competes with LG Display’s White OLED. The second battle is between OLED TV (including both QD-OLED and White OLED) and the highest performance tier for LCD TV, MiniLED TVs. The report tracks the historical pattern of these battles and includes our forecast of how they play out.

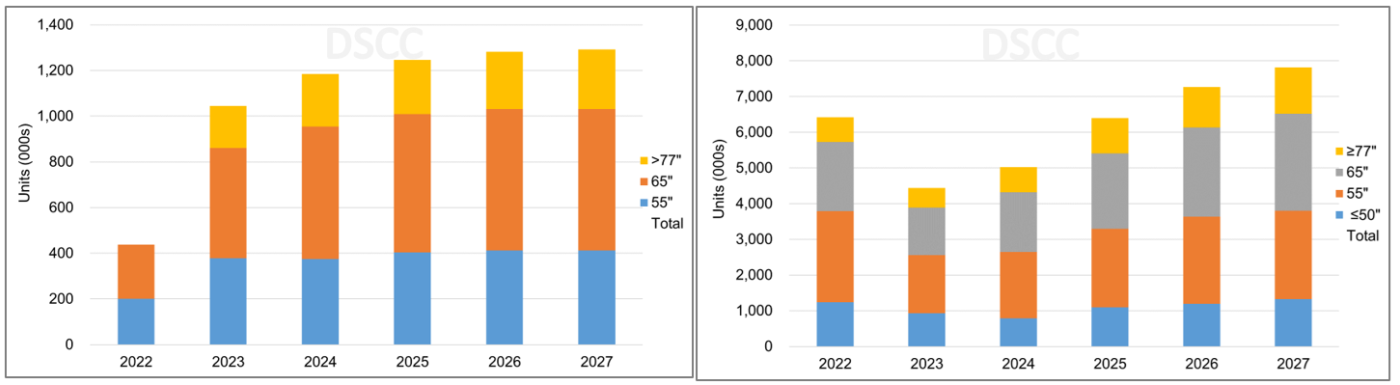

These next charts show our forecast for QD-OLED and White OLED TV shipments out to 2027. Note the different vertical scales. QD-OLED has taken a premium position within the OLED TV category, with higher prices than White OLED, but White OLED TVs are sold by many more brands than QD-OLED. The downturn for White OLED in 2023 is far greater than the gain from QD-OLED; the reduced sales are attributed to excess inventory from 2022.

QD-OLED has an estimated 19% share of total OLED TV in 2023 and will increase to 20% in 2024 but decline slowly thereafter as White OLED grows but QD-OLED is limited by capacity. QD-OLED share in 2027 is forecast to be 14%. In terms of revenues, QD-OLED has an estimated 27% revenue share of total OLED TV in 2023, which will increase to 28% in 2024 but decline slowly thereafter as White OLED grows but QD-OLED is limited by capacity. QD-OLED share in 2027 is forecast to be 20%.

QD-OLED TV Shipments (L) and White OLED TV Shipments (R) by Screen Size, 2022 to 2027

In the OLED vs. MiniLED battle, MiniLED has grown rapidly from 2021 but remains behind OLED in unit and revenue share for 2023. MiniLED has an advantage in LCD cost-effectiveness in 65”/75” sizes because of Gen 10.5 production, and lower costs for >75” panels, but OLED remains the top tier at each screen size with the highest prices and the premium brands.

MiniLED TV share of the premium “MiniLED + OLED” category increased to 40% in 2023 and will continue to increase.

MiniLED TV unit shipments are forecast to surpass OLED TV unit shipments in 2027 with 50.4% share of the premium “MiniLED + OLED” category.

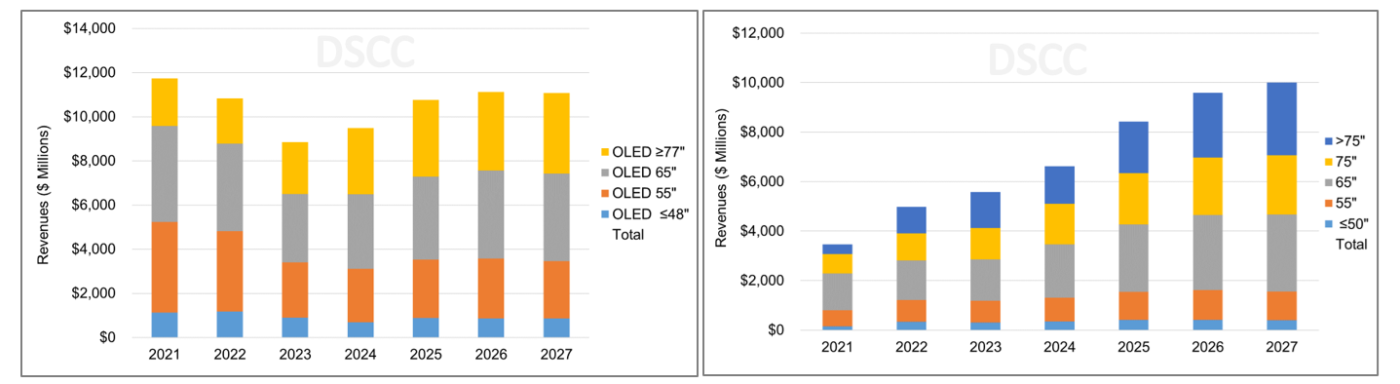

The final set of charts here shows our outlook for OLED TV vs. MiniLED TV in terms of revenues. Again, note the different vertical scales. OLED remains the top tier at each screen size with the highest prices and the premium brands, but MiniLED advantage in large sizes allows its revenue share to nearly match unit share. OLED TV revenue peaked in 2021 and has declined for two consecutive years while MiniLED has grown, and MiniLED TV revenue share of the premium “MiniLED + OLED” category increased to 39% in 2023. While DSCC expects OLED TV revenue to rebound starting in 2024, MiniLED TV revenue share of the premium space will continue to increase to 47% in 2027.

OLED TV (L) and MiniLED TV (R) Revenues by Screen Size, 2021 to 2027

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment history through Q3’23, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast out to 2027 across technology, region, resolution and size. Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact info@displaysupplychain.com.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.