DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 09/16/2024

Advanced Notebook PCs Expected to Grow 36% Y/Y in 2024 – Capturing 8% Share of the Total Notebook PC Market

La Jolla, CA -

- In Q2’24, advanced notebook PCs (OLEDs and MiniLEDs) panel shipments increased 35% Y/Y.

- In 2024, we expect double-digit Y/Y growth for OLEDs and MiniLEDs.

- In 2024, we expect advanced notebook PC panel shipments to account for an 8% unit share of the total notebook PC market.

As revealed in DSCC’s latest Quarterly Advanced IT Display Shipment and Technology Report, advanced notebook PC panel shipments (OLEDs and MiniLEDs) decreased 6% Q/Q and increased 35% Y/Y in Q2’24 as a result of improved conditions during the 1H’24 amid the resurgence of the commercial markets. In Q2’24, OLED panel shipments decreased 13% Q/Q and increased 65% Y/Y and MiniLED panel shipments remained flat Q/Q and increased 20% Y/Y.

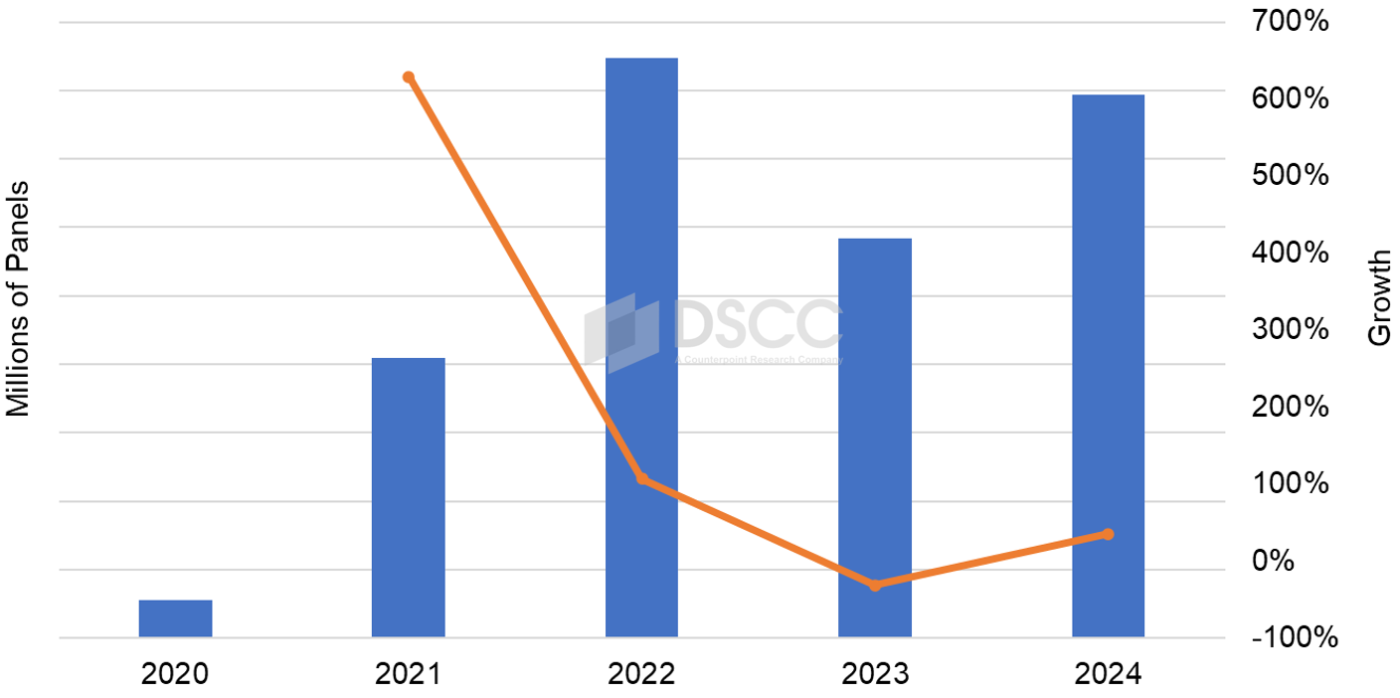

In 2024, advanced notebook PC panel shipments are expected to increase 36% Y/Y as a result of continued demand from the commercial and consumer sector driven by the three-to-five-year replacement cycle, the Microsoft OS update and AI PCs. We expect advanced notebook PCs to account for an 8% share of the total notebook PC market fueled by OLED notebook PC panel shipments increasing 58% Y/Y and MiniLED notebook PC panel shipments increasing 22% Y/Y.

Advanced Notebook PC Panel Shipments, 2020 - 2024

In 2028, as a result of a result of several G8.7 IT fabs coming online in 2025 – 2028 and the expectation that Apple will enter the OLED notebook PC category in 2026, advanced notebook PCs are expected to achieve double-digit unit share and revenue share.

The Advanced IT Display Shipment and Technology Report includes markets forecasts, panel and product roadmaps, cost trends, technology advancements and much more.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.