国内お問い合わせ窓口

info@displaysupplychain.co.jp

FOR IMMEDIATE RELEASE: 04/21/2021

Previewing Q1’21 Display Supplier Earnings – What a Difference a Year Makes

Ross Young, Founder and CEOAustin, TX USA -

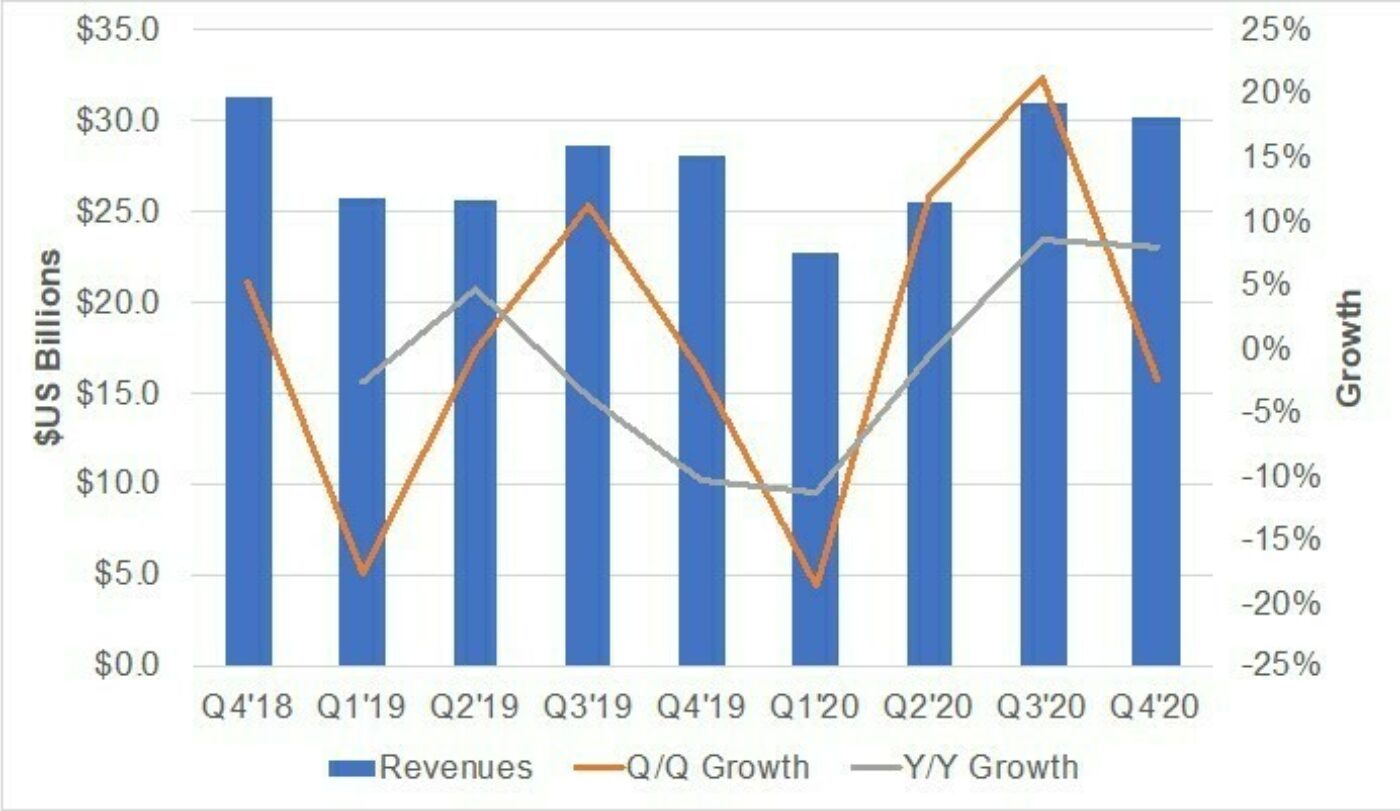

Display makers will without doubt report impressive quarterly results for Q1’21 on a year over year basis. Q1’20 was a low point for display makers with quarterly revenues of $22.8B, the lowest since Q2’16. Revenues of publicly traded suppliers as seen in our Quarterly Display Supply Chain Financial Health Report were down 19% Q/Q and 11% Y/Y in Q1’20 on a combination of both low prices and reduced output with shipments impacted by COVID-19 related supply chain constraints. A year later, it is a very different story. Prices are up, demand is up from WFH/LFH and rebounding economies. With a weak comparable in Q1’20, Q1’21 will likely show record growth.

Display Supplier Quarterly Revenues

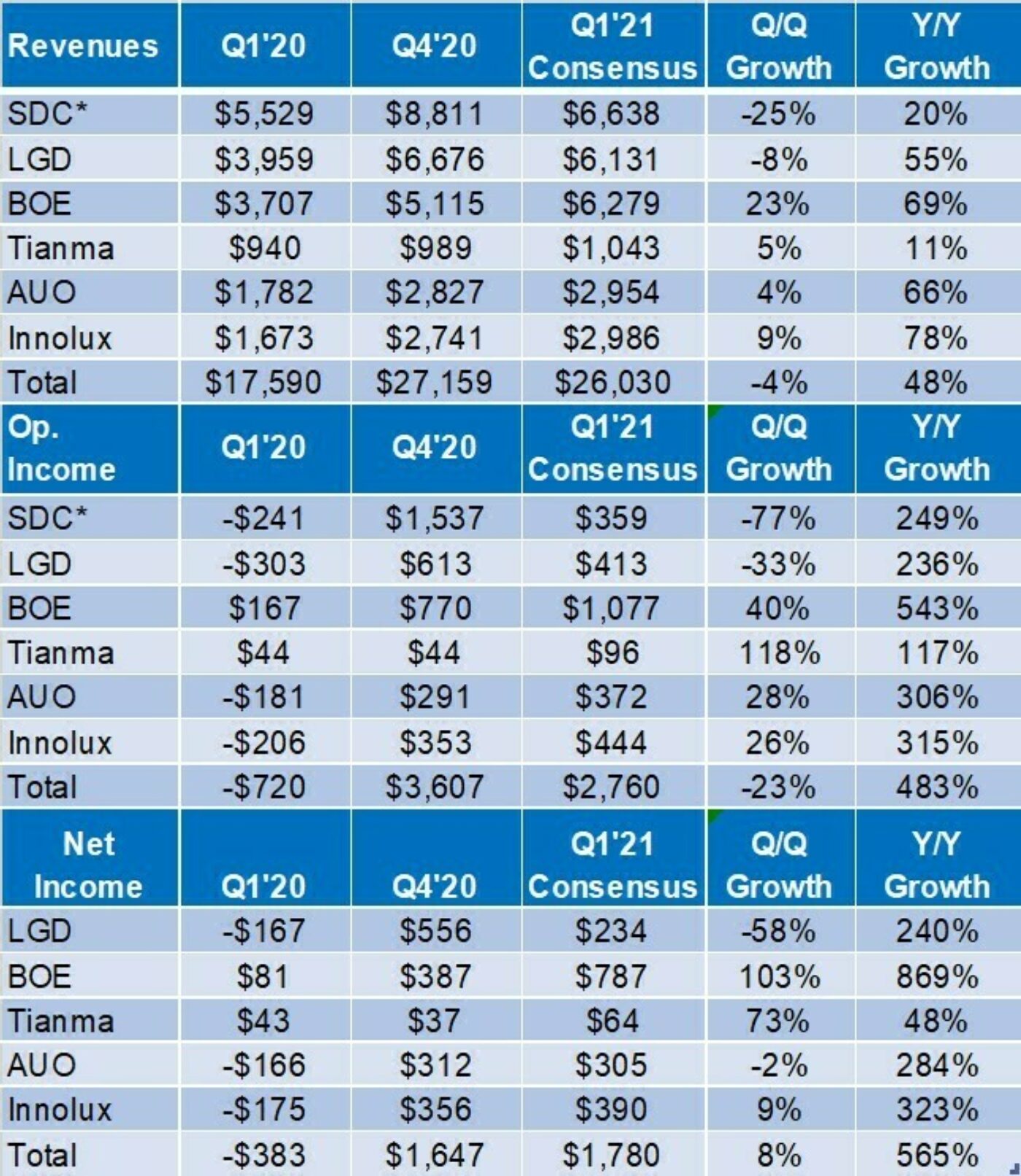

If we look at some of the top suppliers below, we see dramatic Y/Y growth expected resulting in 48% Y/Y growth in revenues, 483% growth in operating income and 565% growth in net income. Operating margins are expected to improve from -4% a year ago to a much healthier 11% in Q1’21. Net margins are expected to improve from -2% to +7%. Our Quarterly Display Supply Chain Financial Health Report goes back to Q1’13 and double-digit operating margins have only been realized in four of the last 32 quarters. The quarter with the highest operating margins was in Q1’17 at 13%. We could see 13% OPMs eclipsed in the next couple of quarters as prices continue to rise helped by driver IC and other shortages.

Financial Results and Q1’21 Consensus for Selected Display Suppliers

AUO and Innolux have already reported their Q1’21 revenues. As indicated, they had massive growth of 66% and 78% Y/Y respectively on higher prices and a richer product mix. They should gain share in Q1’21. The consensus for AUO’s net income is for a 2% Q/Q decline which looks low given the 28% increase in operating income.

BOE has given guidance for Q1’21 earnings whose midpoint is $787M which would be up an impressive 103% Q/Q and 869% Y/Y. As the LCD market leader who is in the midst of ramping G10.5 capacity, BOE is a major beneficiary of the improvement in LCD demand and increases in LCD pricing. The consensus for its revenue growth in Q1’21 in 69%. It will also gain share in Q1’21.

LGD is expected to see a 55% increase in revenues, a 236% increase in operating income with operating income up by $716M Y/Y and net income of $234M vs. a net loss of $167M the prior year. LGD is benefiting from strong mobile OLED growth at Apple, healthy LCD shipment growth at higher prices and increased OLED TV panel shipments as its China fab continues to ramp. DSCC is showing LGD’s OLED smartphone panel revenues up 209% Y/Y and its OLED TV panel revenues up 55% Y/Y. Its mobile OLED profitability will also improve significantly Y/Y. Also of note is that LGD’s operating income should exceed SDC’s operating income in Q1’21. The last time that occurred was in Q1’19.

The consensus for SDC is based on surveys of Korean analysts by The Elec and calls for revenues to fall 25% Q/Q and rise 20% Y/Y to $6.64B. We think these numbers may actually be a little high based on our Quarterly OLED Shipment Report which does a bottoms up analysis of SDC’s quarterly OLED revenues by application, customer and model. We would not be surprised if the top line was ~5% lower. The operating income figure may depend on if SDC takes any charges in LCDs. Analysts expect SDC to incur a KRW 100B ($90M) charge related to its LCD fab shutdowns. Given the seasonality in the smartphone market in Q1’21, we expect SDC’s OLED margins to come down quite a bit. In addition, its LCD revenues and margins will also decline vs. Q4’20 due to the shutdown and sale of its LCD fab in China to China Star and some reductions in LCD capacity in Korea. So, unlike recent quarters, SDC will not be one of the most profitable suppliers as they are not able to take advantage of the turnaround in the LCD market like other suppliers and there is seasonal weakness in smartphones. In fact, this may be the first quarter since Q1’16 that both LGD and BOE enjoy higher operating income than SDC.

We will be sure to report on all panel makers financial results in upcoming issues and you can find more details, analysis, aggregated results and comparisons in our Quarterly Display Supply Chain Financial Health Report.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.