DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 09/16/2024

2024 Will Be a Revival Year for Advanced TV Market with Growth to $30 Billion by 2028

La Jolla, CA -

- In 2024, Advanced TV units and revenues are expected to increase Y/Y by 22% and 15%, respectively.

- Advanced TV units and revenues are expected to increase by a 10% and 4% CAGR, respectively, from 2023-2028.

- MiniLED TVs are forecast to exceed OLED TVs in units and revenue for the full year 2024.

Advanced TV shipments declined in both units and revenue in 2023, but a recovery in both units and revenue started in Q1 2024, accelerated in Q2 and will continue strong through the full year 2024, and we expect growth to continue to 2028, according to the latest update to DSCC’s Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers.

Total Advanced TV shipments increased 45% Y/Y in Q2’24 and we forecast an increase of 22% Y/Y for the full year 2024. OLED TV units increased 2% Y/Y in Q2’24 and we forecast a 4% increase Y/Y for the full year 2024. Advanced LCD TV units increased 53% Y/Y in Q2’24 and we forecast growth of 29% for the full year 2024. Large screens will drive the growth in 2024, as 77”+ OLED TV shipments are forecast to increase by 14%, and >75” Advanced LCD TV shipments are forecast to increase by 105%.

For the full year 2024, we forecast Advanced TV revenues to increase by 15% Y/Y. OLED TV revenues are forecast to decline by 8% Y/Y, with all screen size groups forecast to have revenues decrease Y/Y. Advanced LCD TV revenues are forecast to increase by 29% Y/Y, with 75” revenues to increase Y/Y by 22%, and >75” revenues to increase by 87% Y/Y.

In our updated long-term forecast, total Advanced TV shipments are expected to grow by an 9% CAGR from 2023 to 2028. We estimate that OLED TV units declined 16% in 2023, but we expect them to grow at a 9% CAGR from 2023-2028. We estimate that Advanced LCD TV units increased by 6% Y/Y in 2023 and we expect them to grow at a 10% CAGR from 2023-2028. Including QD-OLED, OLED TV will be reduced to a 26% share of Advanced TV units in 2027, and MicroLED will emerge with very small volumes.

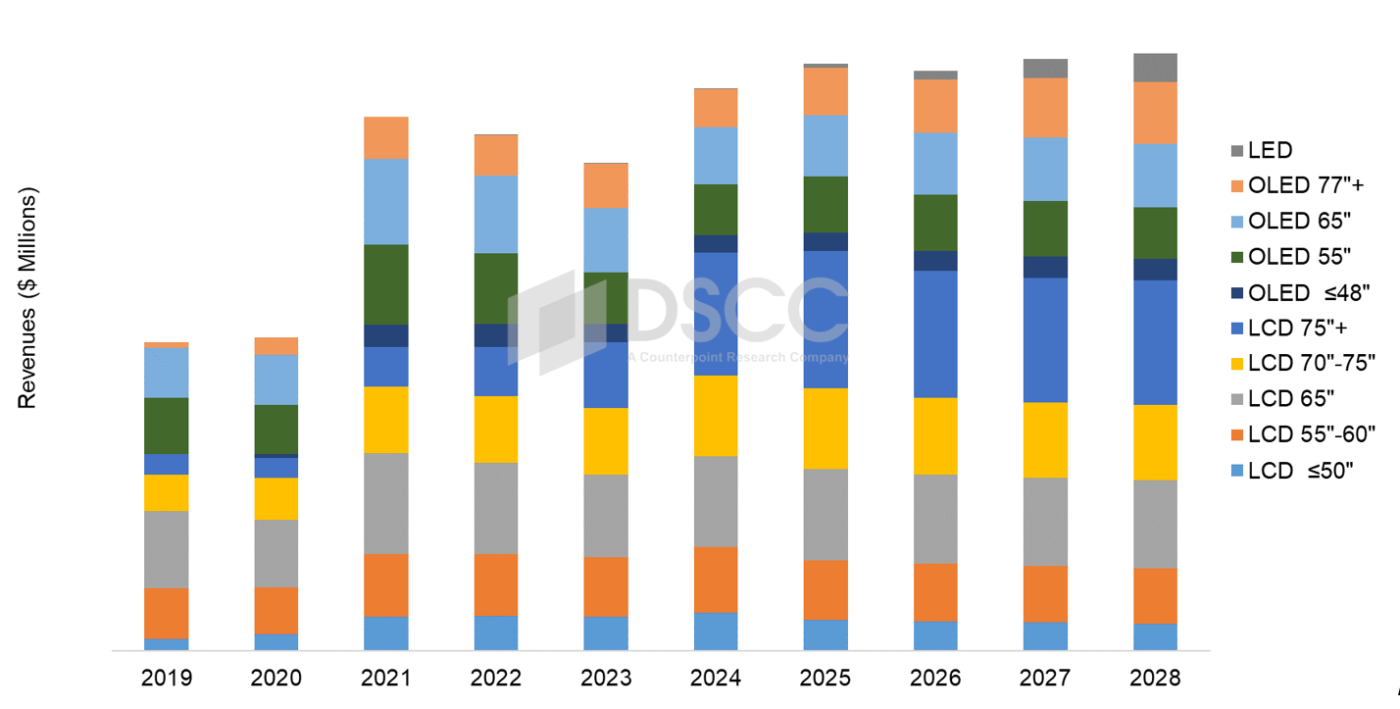

Advanced TV Shipments by Screen Size and Technology, 2019 to 2028

Advanced TV revenues jumped in 2021 with pandemic-fed demand and higher prices. Revenues declined in 2022 by 3% as price declines overwhelmed volume increases and declined another 5% in 2023 as prices continued to decline with soft demand. We expect revenues to surpass the 2021 peak in 2024 and increase by 15% Y/Y. Growth will continue to a new peak in 2028 of $30.5 billion.

OLED TV revenues are expected to grow at a 2% CAGR from 2023 to 2028 to $10.1B but will not exceed the revenue peak in 2021 which happened before MiniLED came on the scene in high volumes. Advanced LCD TV revenues are expected to grow at a 4% CAGR to $18.9B in 2028, but revenues are close to flat for 2026-2028.

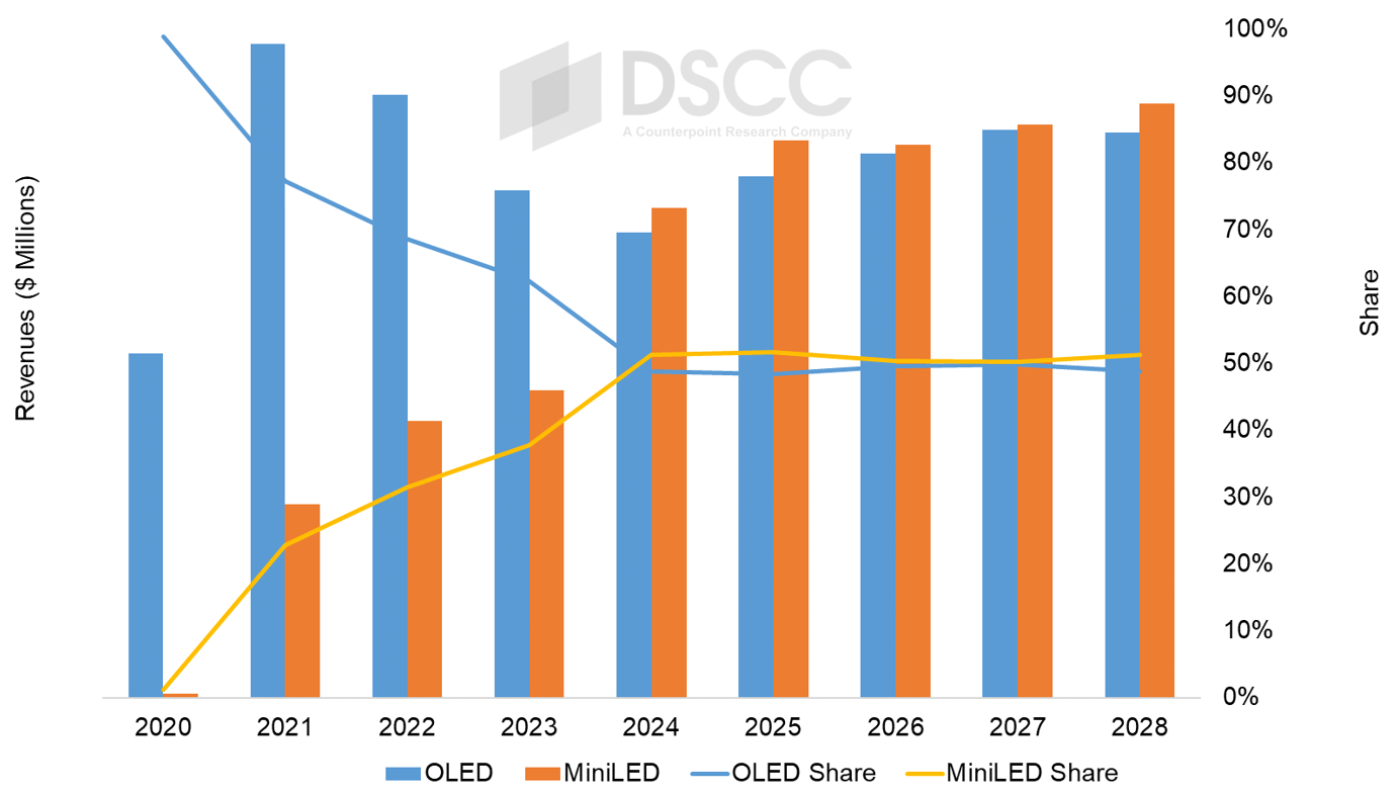

In the OLED vs. MiniLED battle, MiniLED has grown rapidly from 2021 but remained behind OLED in unit and revenue share in 2023. Driven by aggressive pricing and promotion from Chinese brands TCL, Hisense and Xiaomi, MiniLED has surpassed OLED in both units and revenues in 2024, with ultra-large screen MiniLED TVs competing well at price points equal to smaller screen OLED TVs.

MiniLED has an advantage in LCD cost-effectiveness across all sizes but especially in 65”/75” because of Gen 10.5 production, and MiniLED has lower costs for >75” panels, but OLED remains the top tier at each screen size with the highest prices and the premium brands. MiniLED TV share of the premium “MiniLED + OLED” category increased to 40% in 2023 and 54% in Q2’24, and we expect that MiniLED will surpass OLED in both units and revenue for the full year 2024.

Although OLED remains the top tier at each screen size with the highest prices and the premium brands, MiniLED’s advantage in large sizes allows its revenue share to match unit share. OLED TV revenue peaked in 2021 and declined in 2022-2023 and is expected to decline again in 2024 while MiniLED has grown. MiniLED TV revenue share of the premium “MiniLED + OLED” category increased to 38% in 2023 and we expect MiniLED TV revenue share of the premium space will continue to increase to 51% in 2024, and then for the two technologies to stabilize their share, each at about 50% with MiniLED having a slight advantage.

OLED TV (L) and MiniLED TV (R) Revenues by Screen Size, 2020 to 2028

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.