DSCC

info@displaysupplychain.com

FOR IMMEDIATE RELEASE: 02/26/2024

2023 Annual TV Shipments Fall 3%; Chinese Consumers Drive Premium Segment Growth

La Jolla, CA -

- Counterpoint Research initiates global TV coverage with first joint DSCC shipment tracker

- 2023 annual global TV shipments fell 3% to 223m units

- North America market strength not enough to offset China and Europe weakness

- The premium segment fell 1% during the year despite extremely strong growth in China

- We expect premium to grow by mid-single digits in 2024 on US and Europe recovery

Counterpoint Research is initiating coverage on Global TV shipments with its Global TV Shipment Tracker, a quarterly report split by region, screen size, resolution, ASP and other features. It is the company’s first joint product with DSCC since acquisition, with the latter providing enhanced details on premium segments including advanced display technologies across OLED (includes QD-OLED), Mini/MicroLED, quantum dot LCD and others.

“We’re really excited to roll out the Counterpoint Research Global TV Tracker which is a powerful tool helping users assess market and technology trends as well as the competitive environment,” says Tom Kang, Research Director. “As the first joint product built between Counterpoint and DSCC, it also shows how we’re bringing additional value to clients with the net result much greater than the sum of its parts.”

According to Counterpoint Research’s Global TV Shipment Tracker, 2023 shipments fell 3% annually to 223m units as strength in the US market was not enough to offset market declines across China and Europe.

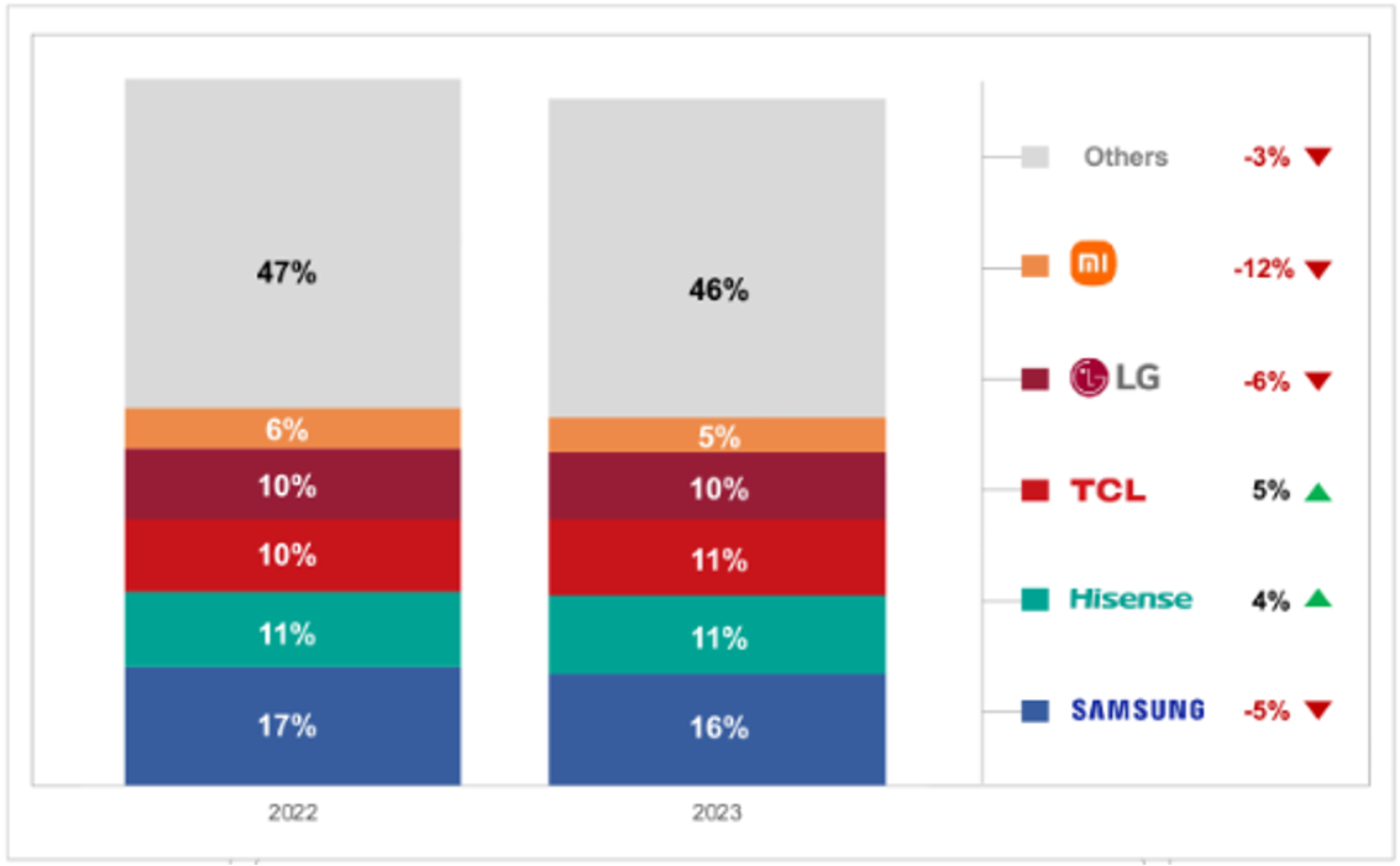

Global TV Shipment Share

Samsung Electronics remained in top spot while Chinese vendors Hisense and TCL grew by mid single digit percentages riding the growth in North America.

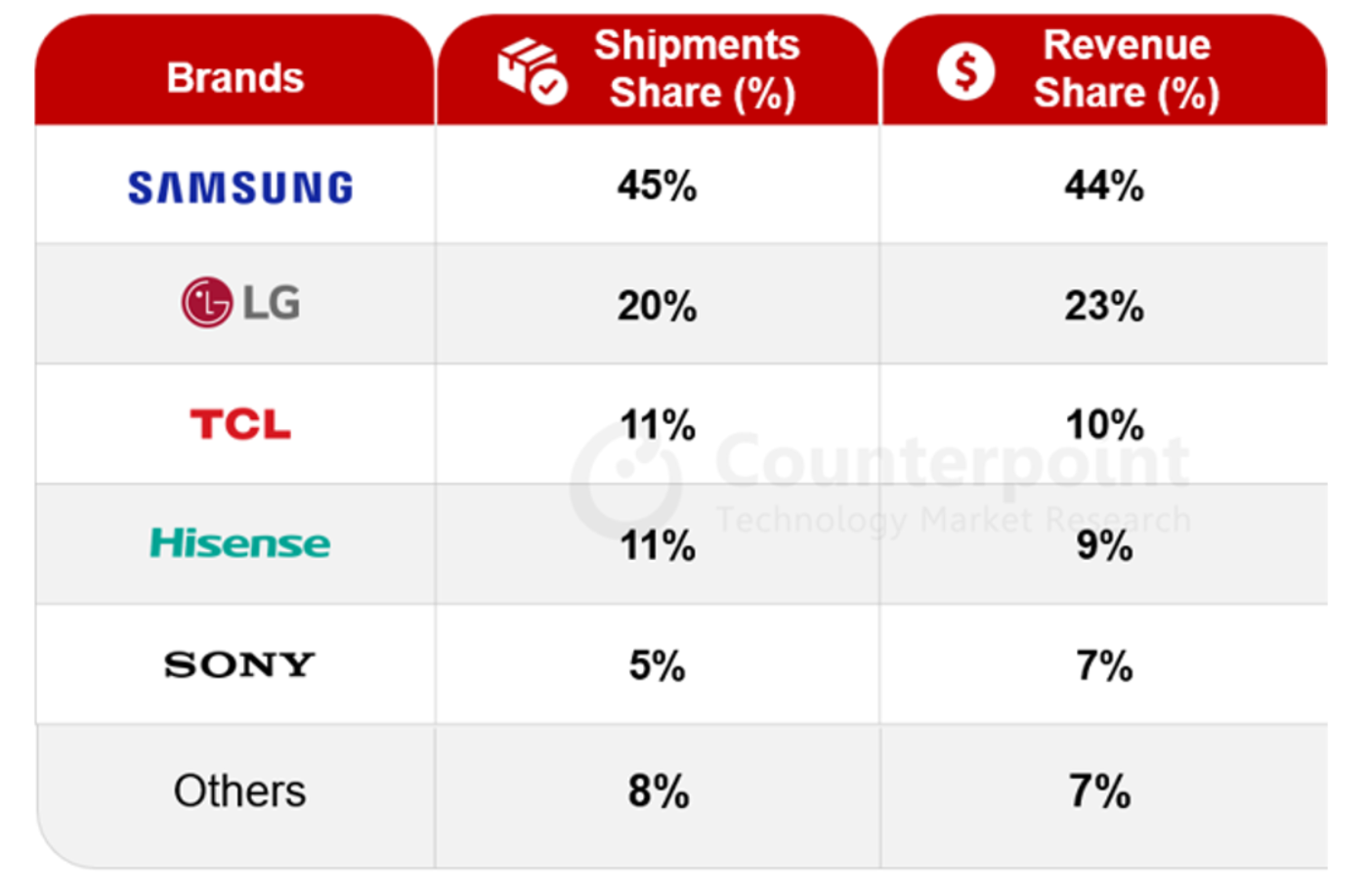

Premium shipments for the year decreased 1% annually but increased to 10% of the overall market helped by a surge in China, which grew by an astonishing 39% and 49% in shipments and revenues, respectively. A clear shift towards MiniLED LCD TVs by key Chinese OEMs coupled with aggressive pricing and promotions helped to drive the segment domestically.

Global Premium TV Shipment and Revenue Share

About Counterpoint

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

About Counterpoint

Counterpoint Research acquired DSCC (Display Supply Chain Consultants) in 2023, joining forces to become the premier source of display industry research globally. The partnership combines Counterpoint’s thought leadership and expertise across the broader tech sector and DSCC’s deep specialization in display technologies to provide an unparalleled resource for insights and analysis for our clients.